Your credit score has become more important.

In recent times the banks and other lenders have become more focused on assessing your credit worthiness.

When you apply for credit they will access your credit check which provides them with your score as well as a lot of other information.

We rarely discuss credit reports and scores and most people don’t even know what they are, but you should take more notice as they can impact on your future when you need to get credit of any kind including a home loan.

A study in 2016 by Credit Simple reported that *92% of Kiwis don’t know their credit score, 72% don’t know what a credit score is, and only 13% have requested their credit file and while that report is a little old, we expect that things have probably not changed all that much.

What Is A Credit Score?

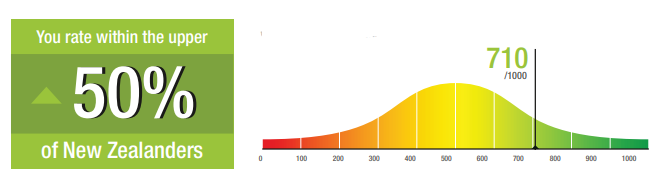

A credit score summarises information on your credit report into a number which shows your credit worthiness and it is used to help lenders decide whether or not to loan money or provide credit and on what basis. The score is a numerical value reflecting your credit worthiness, and ranges between 0-1000.

The higher your score the better your are deemed to be at managing your finances.

Credit scores are a combined history of all your payments, including credit cards, mortgages, car finance, hire purchases and bills. The score is a numerical value reflecting your credit worthiness, and ranges between 0-1000. The higher your score the better your relationship with managing your finances.

How Credit Scores Are Calculated

This number represents how your credit risk measures up against other New Zealand’s.

Your score is an evaluation by a credit-reporting agency: Equifax and Illion score out of 1000, Centrix out of 1500.

The score itself is created based on the positive and negative financial history within your credit file. It can be improved if you pay off loans on time and keep up to date with the likes of utility and phone bills, but your score worsens if you miss bill payments, default on your loans and/or pay utility bills late.

There are additional factors that make up your final credit score, including:

- The age of your credit file and average age of your accounts

- The number of enquiries you’ve made into your credit file over the past four years

- Stability of home address – how often you have moved address

- The number of accounts you hold and how many you’ve opened recently

- How active your accounts are, including home loans, vehicle loans, private bank loans, student loans, rent payments and retail instalments

- Any overdue or late payments on any credit including payments on everyday expenses like utility bills including energy, electricity, gas and phone bills

- Court judgements against you, outstanding debts, Non Asset Procedures, Summary Installment Orders and bankruptcies

Your credit score is one significant thing that lenders look at when assessing an application for finance, but they will consider additional factors too.

However, it has been reported that up to 35% of Kiwis are unable to borrow from their banks due to poor credit files and resulting low credit score and this is one reason that non-bank lenders have become a more popular option in New Zealand.

Does My Credit Score Matter?

The simple answer is “YES” it does matter a lot when you want to get credit or borrow money.

Often the cheapest way to borrow money is from a bank (not always) and they are very focused on your credit score. Banks will generally decline anyone that has a low credit score and/or defaults listed on their credit reports – especially if you have a default to a financial institution.

While the non-bank lenders will provide finance for someone with a low credit score, they will often charge a higher interest rate when the credit score is low, if there are defaults or other credit impairments.

As mortgage advisers we will often use non-bank lenders when we have to, but will review and refinance the home loan once the credit score improves.

How Can I Check My Credit Score?

There are three credit reporting agencies in New Zealand, Centrix, Equifax (formerly Veda) and Illion (formerly Dun & Bradstreet).

Its free to request a copy of your credit file, you can apply online with a form of ID verification (e.g. NZ driver’s license).

CLICK HERE to get your credit report from Centrix

CLICK HERE to get your credit score from Equifax

It is a very good idea to get a copy of your credit report so you can review it and ensure the information is correct.

If there is anything on there that looks wrong you need to address it with the credit reporting agency and they are obliged to look into it for you – they do sometimes make mistakes or get provided with incorrect information.

Don’t Worry!

Your credit score isn’t set in stone and can be improved!

It takes time and effort, but you can improve how your credit check and score look.

Learn More: How To Improve Your Credit Score

Paying your bills on time, or early, keeping up to date with loan repayments, and managing monthly spending can improve your credit score.