When you find a house you want to buy, or when you are refinancing your mortgage your impulse may be to move quickly to lock in a mortgage rate — especially in a competitive market like we have today.

But you don’t want to move so fast that you end up with a bad deal.

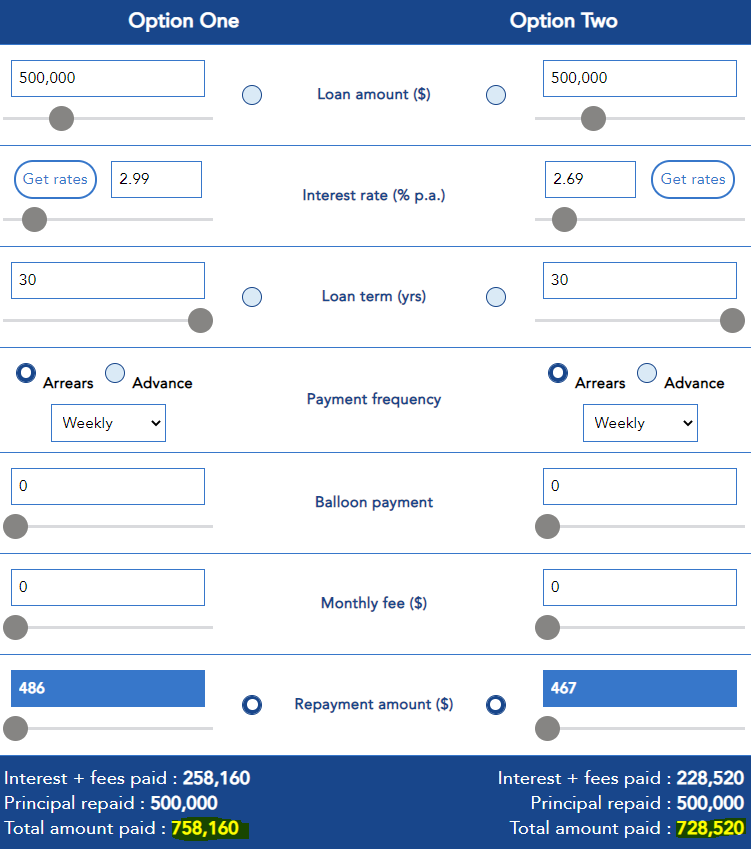

Even a slightly higher rate can add tens of thousands of dollars in interest over a 15- or 30-year loan term.

There’s always time to explore your options, even if the clock is ticking.

Don’t Just Default To The Existing Bank

You may think that your existing bank is going to look after you best; however that is not always the case.

Often banks will be more driven to get new business rather than look after their existing customers. They know that most people think it’s a bit of a hassle to switch banks and therefore most customers will not bother to change banks even if they know another bank is prepared to look after them better.

You might change your mind when you actually see how much you could save!

Mortgage advisers can do the hard work for you so switching banks can actually be quite easy.

An adviser can show you the benefits of switching banks and may also be able to negotiate a cash incentive for you.

But also you need to consider the costs of changing banks.

Get Shopping For The Best Mortgage Rates

When you start shopping for the best mortgage rates you need to consider more than just the advertised interest rate.

Most banks are prepared to match or better the rates offered by the other banks, so for this reason it’s important to know what the various banks are prepared to offer.

You could ask a mortgage adviser to do this for you as they are dealing with the banks every day, and should know which banks are doing the best rates at any given time. They will also usually not charge for this service as the banks pay them a fee when they refix your loans. If you are going to use a mortgage adviser you should select one that works in a busy office as they tend to provide the banks more business and therefore are generally looked after better.

Or you could approach the banks yourself if you have the time and think you can negotiate a better deal. If you plan to find the best mortgage rates yourself then you need to consider which banks to approach as you probably will not have the time to approach them all. Selecting the banks to approach can be difficult as you may not know what banks are offering, so will default to what you see advertised. There are websites that have all of the advertised mortgage rates listed so these can be a good starting point.

Small differences in the interest rates can lead to massive savings over time, especially in the early years when the mortgage is generally quite large.

In this example you could save almost $30,000 by just getting a 0.30% lower mortgage rate. That’s about $1,000 per year for the 30-years, or about $20 per week.

Why let the banks keep this money?

With a little bit of effort you can get these types of savings rather than leaving that money as bank profits.

Think Carefully About Your Loan Structure

You shouldn’t just take the lowest interest rate as that may not work with the strategy that you have.

They always say it’s not the interest rate that is the most important, but rate that you repay the mortgage. The interest rates are important, but you need to take advantage of consistently competitive (low) mortgage interest rates and make sure that you are paying off your mortgage faster as that is how you will make significant savings over time.

You want to ensure that you have the best rates, but also the flexibility to pay more onto your mortgage.

When mortgage advisers talk about loan structures they will normally suggest a combination of loans rather than lumping all of your debt onto a single loan.

Today’s Mortgage Rates

If you’re here, you probably already know that mortgage and refinance rates are at all-time lows.

This is a rare opportunity to lock in a historic rate before they rise again, but will they rise and if so when?

Just make sure you explore all your options, because the first rate you’re offered is hardly ever the best deal.

Remember too to summarise the overall lending as the banks will often adjust the rates they are willing to offer on the basis of how strong they deem the deal. Things like the loan size, the level of equity, your income and other factors can make a difference to what they can offer.

There are also some “deals” for certain industries, but currently the rates offered will almost always beat the standard deals offered.

Also if you are comparing mortgage rates you need to make sure you are comparing the rates provided on the same day as this gives you a fair comparison.

Let’s Look At The Tips We Can Give You

Let’s Look At The Tips We Can Give You

Here are five easy tips that can help you when shopping for the best mortgage rates.

- Decide on the best loan structure – do this before you start shopping for rates

- Look beyond your existing bank – don’t assume that they will be the best option as they often don’t

- Know what a good deal looks like – you need to research the market so you know what you should be offered

- Check all your finances – make sure you consider non-mortgage finance that you may have too

- Seek expert advice – if you are not sure or just want to know that you are getting the right loan structures and the best mortgage rates then you should contact a mortgage adviser. Most good advisers will assist at no charge to you as they get paid by the banks.

Finally, and as mentioned before it is not worth rushing this process.

Getting the right mortgage rates can save you thousands of dollars over the term of your loan, so take this seriously and make the right decision.

Complete the form here and speak with one of our team for free., and it could save you more than you might expect.

A 5-minute conversation could save you more than you might expect.