As mortgage advisers we are often asked can I pay more off my mortgage?

The answer is YES however that is often followed by a BUT …

It depends on what bank you are with and how you have structured your loans.

What Banks Generally Don’t Explain

When most people get a mortgage they are happy to have been approved for the loan.

The bank will then offer them some options on interest rates and will give a brief explanation on the features of the loans that they offer. Of course a banker will only focus on the home loans that their bank offers, and in most cases probably doesn’t know how the other banks loans differ from what they offer.

The loan structures that we see where banks have set them up are often just a fixed loan, and typically they defer to the 2-year fixed period. It’s like they just want to make it easy and “set and forget” the loan for a couple of years.

When we get to review the mortgages for people in situations like this they are often disappointed with how little they have paid off their mortgages and are therefore keen to know how to structure the loans better so they can pay their mortgage off faster.

This conversation will also include reviewing what bank they are with as some banks offer more flexible options.

How Mortgage Advisers Structure Loans

In most cases our recommended loan structure for a mortgage on your home will be to have a small revolving credit account (Flexible loan) and then the majority of your mortgage will be fixed, but split into two separate fixed loans.

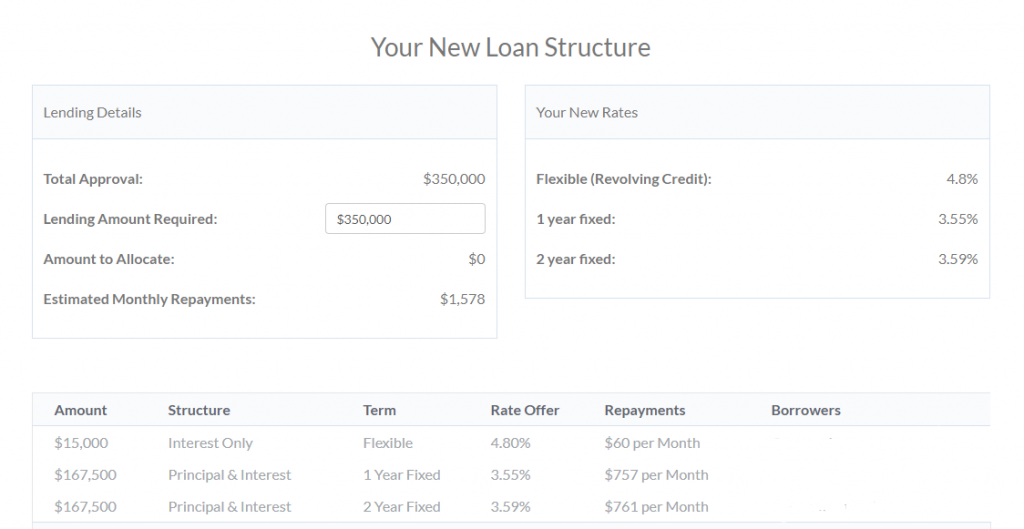

A good example of a loan structure will be;

This is an actual loan completed on 30th August 2019.

Flexible Loans (Revolving Credit)

The advantage with a Flexible loan (Revolving Credit) is you do have flexibility with the repayments – you have the ability to increase then decrease your loan repayments and/or to make lump-sum repayments; however the disadvantage is that the interest rates are higher and you are also exposing yourself to additional risk with possible interest rate increases.

Fixed Home Loans

People love fixed home loans as you get lower interest rates and have certainty for a period of time – you know exactly what your repayments are.

But there are disadvantages with fixing your loans as you lose the flexibility which means it is more difficult to increase or decrease your loan repayments and there are limitations on making any lump-sum repayments too.

You will see that we generally recommend that you split your lending into two fixed loans too, and may wonder why.

Splitting Your Fixed Loans

There are two main reasons to split your fixed loans;

- It spreads the risk with what we call interest rate averaging.If you wanted the cheapest possible interest rate today, it’s likely you would fix your whole mortgage for one year as this rate is usually the banks cheapest headline rate. However, this isn’t necessarily a good idea. If rates next year were significantly higher, you would have to refix your home loan at a much higher rate and face a massive increase to your costs, which may make budgeting very difficult. Similarly, if you wanted the ultimate in long-term security you might choose to put your whole loan on a 5 year rate. This is great, as long as interest rates don’t fall. If they do, you’ll be stuck on a high interest rate when everyone else is on a significantly lower interest rate.Nobody can see into the future and this concept of interest rate averaging is a great way to hedge your bets.

- It gives you more flexibility. Many banks will allow you to make changes to your loan repayments or to pay additional lump-sums but there are limitations. Some of the banks limit what you can do to your overall lending, but others look at it on the basis of a specific loan which means if you have two loans you may double up on the opportunity that you have.If you do have to break a fixed loan it may be that you can break just one of the loans which means that any break costs are reduced.

These are two of the main reasons that your mortgage adviser would recommend splitting your fixed loans.

You may find that some banks are not keen on splitting loans as it does create more work for them; however as mortgage advisers we almost always will set up loans like this.

Can I Pay More Off My Mortgage?

With a Flexible loan (Revolving Credit) you do have flexibility with the repayments to increase and decrease your repayments; however with fixed loans the banks have rules on what you can or cannot do.

This is where our mortgage advisers focus on selecting the best home loan so you can pay more off your mortgage rather than just selecting a bank that the person already banks with or a bank that someone likes or finds quicker or easier to get an approval with.

For anyone keen to pay their mortgage off faster these are the key thinks that you should consider when selecting a home loan;

Competitive Interest Rates – everyone wants to know that they are getting competitive interest rates. As mortgage advisers we focus on ensuring that the rates are always “competitive” rather than the lowest advertised rates on any given day. Luckily in New Zealand the banking market is a competitive one and most banks will match the other banks rates so we are very successful in getting and continuing to get good interest rates.

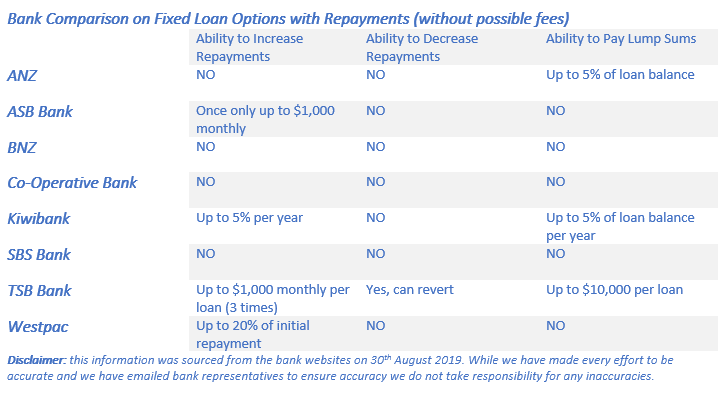

Ability to Increase Repayments – you can increase the repayments when you set up a loan, and a number of banks will allow you to increase the repayments during a fixed term. You can see in the table below which banks allow you to increase the repayments during a fixed term and the limitations for the specific banks.

Ability to Decrease Repayments – it’s great to be able to increase your repayments within a fixed term as this is one of the best ways to pay your mortgage off faster; however sometimes circumstances change and you may need to lower your repayments again. Unfortunately only one bank gives you the ability to automatically do this without penalty.

Ability to Pay Lump Sums – having the ability to pay lump sums on a fixed loan can be extremely useful and helps you pay your loans off a lot faster.

How Serious Are You About Paying Off Your Mortgage?

We see lots of people that say they want to pay their mortgage off faster, but in most cases they do not really want to make the changes that are needed.

The banks rely on complacency – it is not realistic to think that the banks want you to pay your mortgage off faster as surely they would rather you have a big loan and pay them more interest.

As advisers we want you to know how to pay your mortgage off faster and will do everything we can to help you achieve that goal.

What can we do to help?

Firstly we do the research on the various banks to show you which banks offer you the best home loans

We can give you advice and help you structure your loans

We can help negotiate the best home loan interest rates both now and in the future

We can give you discounted access to our mortgage reduction system; Eat My Mortgage

All you need to do is contact us to get started now.