Have you heard people telling you this … switch banks and pay your home loan off faster.

Do you have to switch banks?

How do you pay your home loan off faster?

As mortgage advisers we source home loans for people.

But we also like to provide you information that can help you manage your home loans better and and ultimately pay your home loan off faster.

Benefit From Free Advice

Benefit From Free Advice

People often ask what mortgage advisers do.

Some think that our role is just to source a home loan and because of this they may choose to go straight to the bank.

An advisers role is to source home loans, but it’s also to explain the options, set up the loan structures and of course review existing home loans to see if things can be improved.

Often when we review home loans we see things that could be done better and this includes the way the loans are structured and the way they are managed.

You may want the flexibility of floating interest rate loans, but also want the certainty with fixed interest rate loans.

First you should know what makes a good fixed loan.

Get The Right Fixed Home Loans

Most people probably think that all home loans are the same, but they are not quite the same…

When banks design their home loan options they include things that they think people might want or at least include the features that are easy to “sell” however they tend not to focus on thinks that may allow you to pay off the home loan faster. After all the banks make money when you are paying a debt to them, not when you have paid your debts off.

For anyone keen to pay their mortgage off faster these are the key thinks that you should consider when selecting a home loan;

You Want Competitive Interest Rates – everyone wants to know that they are getting competitive interest rates. As mortgage advisers we focus on ensuring that the rates are always “competitive” rather than the lowest advertised rates on any given day. Luckily in New Zealand the banking market is a competitive one and most banks will match the other banks rates so we are very successful in getting and continuing to get good interest rates.

You Should Have The Ability to Increase Repayments – you can increase the repayments when you set up a loan, and a number of banks will allow you to increase the repayments during a fixed term. You can see in the table below which banks allow you to increase the repayments during a fixed term and the limitations for the specific banks.

And, The Ability to Decrease Repayments – it’s great to be able to increase your repayments within a fixed term as this is one of the best ways to pay your mortgage off faster; however sometimes circumstances change and you may need to lower your repayments again. Unfortunately only one bank gives you the ability to automatically do this without penalty.

Plus You Need The Ability to Pay Lump Sums – having the ability to pay lump sums on a fixed loan can be extremely useful and helps you pay your loans off a lot faster.

These are four of the main criteria for selecting a home loan if you are serious about paying it off faster.

Good Mortgage Managers Do The Research

Unfortunately the banks are not good at providing advice.

At best they will explain the features of their own bank products, but they tend to know little about the other banks products and therefore are not able to advise you well.

The banks generally tend to let you believe that all loans are the same and its the interest rates that are the key differentiation between the various banks loans.

As mortgage advisers we know that you rely on the advice that we provide and to enable us to provide the best advice it means we need to do the research.

We research the banks policy so we know which bank will approve your application, but more importantly we also want to know which bank makes it easy to pay your home loan off quicker. Over the long term this is what is going to make the most difference for you. As mortgage advisers we are often asked “can I pay more off my mortgage faster?” and we published our research here.

Your home loan is probably your biggest financial commitment (debt) and while interest rates are important its the ability to pay it off faster that should be the main focus.

It can make a huge difference and that is why some of the best mortgage brokers not only focus on sourcing home loans, but they also have strategies and ideas to help you pay them off.

It’s another reason to use a mortgage broker.

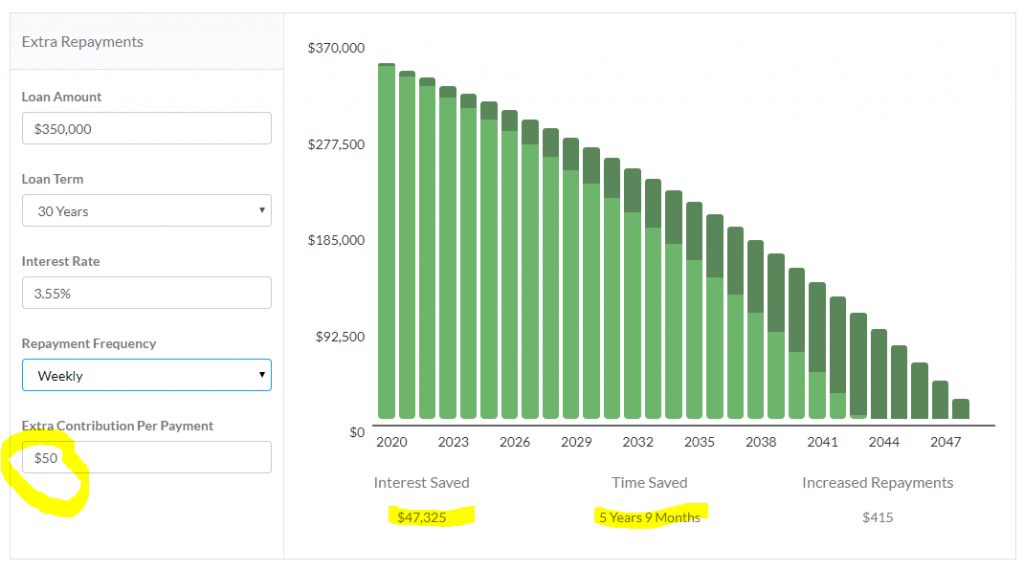

As illustrated here, a small extra repayment of $50 a week could save our client $47,325 and have her home loan paid off 5-years and 9-months earlier.

One Bank Has All The Features

You would think that the banks would make it easy to pay your home loan off faster, but they are in the business of lending money to you.

It is however good to see that one bank does have the four key features listed.

That bank is TSB Bank.

You can read on their website more details on these options which include making additional payments, changing payments.

StepUp is another useful option they have which is an automatic feature to increase your repayments a little each year.

Do You Want To Refinance Now?

It makes sense to have your home loan with a bank that makes it easy for you to pay your home loan off quicker.

Of course, it may seem like a bit of a hassle to refinance your mortgage, but as advisers we can take care of this for you – we can make it easy to switch banks.

We have already told you which bank it is, and of course we know that you could always go directly to the bank; however there are more benefits in having us arrange your mortgage.

- As mortgage advisers we can get your home loan approved with TSB Bank, we can help structure your loans and ensure that you get the best home loan interest rates.

- We can also offer you 3-months access to the mortgage reduction system Eat My Mortgage at a discounted rate of $14.95 monthly for the first 3-months. This is a unique offer that we can provide you and another reason to contact us.

Of course, we would love to help you to refinance and ultimately get your home loan paid off faster.

Get started now – you can switch banks today and it is as simple as completing the form below.