As mortgage brokers we can arrange home loans with most banks and non-bank lenders including Westpac, but we also can help people negotiate interest rates when their fixed rates are about to finish and today we arranged some lower Westpac interest rates for Jonathan.

I thought we should explain how this works.

Jonathan Approached Westpac First

Jonathan has had his mortgage with Westpac for many years and had a loan due to come off it’s fixed rate. He received a letter from the bank offering him the standard advertised Choices rates and the 3-year rate offered was 4.99%.

He looked on the Westpac website and saw they were offering a “special” 3-year fixed rate of 4.49% and decided to phone the bank and asked why he was not being offered the special rate.

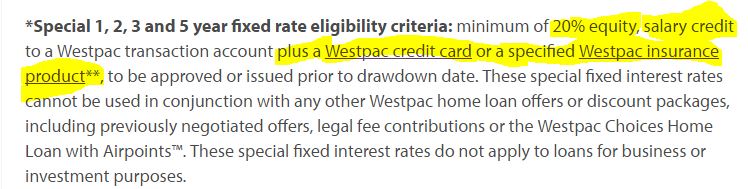

The helpful lady who answered explained that he did not qualify as he did not have his salary going into a Westpac account and did not have a credit card or insurance with Westpac. She explained that these are conditions for getting the special home loan interest rates.

It’s true – this is what the eligibility criteria is for the special Westpac interest rates.

Jonathan was not impressed with this and so the helpful lady managed to offer him a special 3-year rate of 4.49% anyway.

In most cases I expect that someone like Jonathan would have then agreed to that rate and been pleased that they had managed to get Westpac to do the right thing and offer them the best rate, but Jonathan had doubts and needed to know he was being looked after properly by his bank.

Jonathan Contacted The Mortgage Supply Company

Jonathan had not used a mortgage broker before but wanted to speak to someone to ensure that he was getting offered the best Westpac interest rates.

He asked around to find out who would be the best mortgage broker to speak to and it was recommended that he speak to myself – Stuart Wills.

I had arranged a home loan and some very good interest rates for some people who attended his church and they sang my praises; however they had told him that I was with Mortgage Link which as true, but in June we resigned from Mortgage Link to join The Mortgage Supply Company. Jonathan ended up speaking to someone at Mortgage Link but was not convinced that they would be able to help, and then another friend of his suggested I was with The Mortgage Supply Company now – so he made contact.

Jonathan phoned and we discussed interest rates and his situation and it appeared to me that Westpac were not being as helpful as they could. I met with Jonathan and gathered the information that I needed so we could approach Westpac and ultimately to ensure that we could get better Westpac interest rates for Jonathan.

We Got Better Westpac Interest Rates

When a professional mortgage broker goes to a bank (any bank) to negotiate interest rates the broker will know what the other banks are offering, and therefore how much to push the bank for better interest rates. The banks also know that a broker may recommend shifting to another bank if the rates are not good enough, and there are some less reputable mortgage brokers that may refinance you to another bank purely because they will then get paid a commission; regardless if this is the best thing for you – the customer.

The Mortgage Supply Company has a very good reputation for being ethical and that was the main reason we joined them.

I approached Westpac on behalf of Jonathan and negotiated better rates for him.

Jonathan wanted to refix for 3-years and we managed to get him a rate of 4.34% which is a competitive rate, but he also has a revolving credit account and we got the Westpac interest rates discounted by 0.55% on that loan too.

Overall we saved Jonathan over $900 for each of the next 3-years.

That is a $900 saving on what Jonathan was able to negotiate himself and that is real money that he can now use to pay the home loan off quicker or to use on something else.

Best of all it cost Jonathan nothing to get us to help as we are paid by Westpac.

We Keep The Banks Honest

As mortgage brokers or advisers we pride ourselves on the work that we do for people, and of course the money that we are able to save people. Like you, we know that the banks make a lot of money and we see them continuously announce massive profits so we know that they are able to be more competitive with the home loan interest rates that they offer you.

We are in a strange business where we work for you, but get paid by the banks.

The reality is it is better for the banks to work with brokers (and pay them – us) so they can retain customers rather than see those people go to a different bank. We see part of our job is keeping the banks honest and ensuring that they do offer you a good interest rate.

We also believe that loan structure and strategy is important.

Home loans are big financial commitments (debts) and everyone should have a strategy to ensure that the loans are structured to suit you and that they can be paid off more quickly.

I recently wrote a blog post on how to choose the best home loan and it is worth a read too.

Please remember that we will speak to anyone about their home loans – you do not need to have had it arranged by us, we are happy to help you with any loans and like we did with Jonathan and his Westpac interest rates.