People will consolidate debts for a number of reasons but sometimes this is done to ‘make things easier’ and without putting enough thought into it.

Of course home loan interest rates are generally cheaper than interest rates on credit cards, store cards, hire purchase agreements and personal loans. For that reason it seems to make sense to consolidate those debts (higher interest rate debts) into your home loan which has a lower cost.

And it does make good sense too.

The key thing that you need to remember is the loan term.

Home loans are often paid back over a term of up to 30-years and when you consolidate debt into your home loan that extra debt is paid back over that same term which can end up very expensive.

With the debt you are consolidating you need to consider the term of the loan. If the original purpose of the loan was for a vehicle then you need to remember that that vehicle will need to be replaced again ( a few times) within the next 30-years so rather than having this debt consolidation loan spread over 30-years you should consider having it paid off within 3-years or 5-years.

Consider carefully…

Is Debt Consolidation A Good Idea?

Some loans that you have might be almost paid off, interest free or there is no discount on the interest charged if the loans are paid off early. In these cases there may be minimal benefit of consolidating these loans.

Most banks offer the best home loan interest rates when you have equity in your property of at least 20% and therefore after you have consolidated the debts you still need to have 20% equity to maximise the benefits.

If you are not a home owner or do not have enough equity in your home then the benefit of doing a debt consolidation loan is reduced. It can still make good sense if you can get rid of credit card debt at 19.95% or a store card or hire purchase at 29.95%, even if the debt consolidation loan is at 14.95%.

If you are unsure you can talk to one of our advisers who can help you.

An Example Of Debt Consolidation

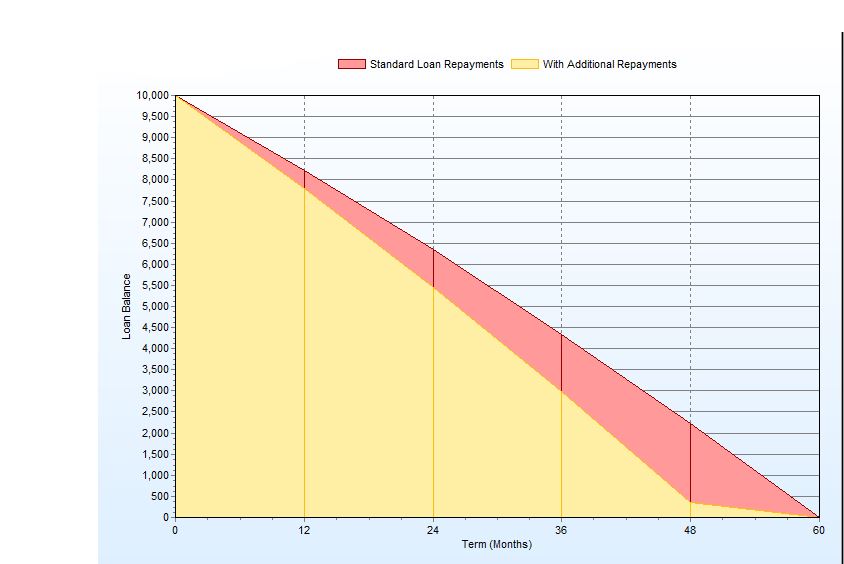

You might have a $10,000 car loan with an interest rate of 12.95% and payable over 5-years therefore the loan repayments would be $227.27 monthly.

You could consolidate this car loan into your home loan and assuming a floating rate of 5.75% you could either;

- Pay the $10,000 loan off over 30-years and your repayments are significantly lower at $58.36 monthly, but you will pay $20,880 over the loan term.

- Pay the $10,000 loan off over the same 5-year term and your repayments reduce by $35.10 to $192.17 monthly.

- Keep the same repayments of $227.27 and pay the loan off a year earlier which means you save $271.82 of interest.

This graph shows option 2 versus option 3;

The purpose of debt consolidation should be to save you money over the long-term and while there are times when reducing the repayments to the lowest amount might be appropriate you need to make sure that you do not lose focus of the ultimate goal of being debt free.

Another Debt Consolidation Tip

When you are ‘sold’ short term debt like credit cards, store cards, hire purchase agreements and personal loans the person arranging the loan will try and sell you loan repayment insurance with the loan.

If you have this insurance included with your loan and you repay your loan off early you should be entitled to a refund of the unused portion of the insurance.

In most cases you will not automatically be refunded the insurance so you will need to request this when you inquire about the repayment amount.

Contact an adviser who can help you with your debt consolidation.