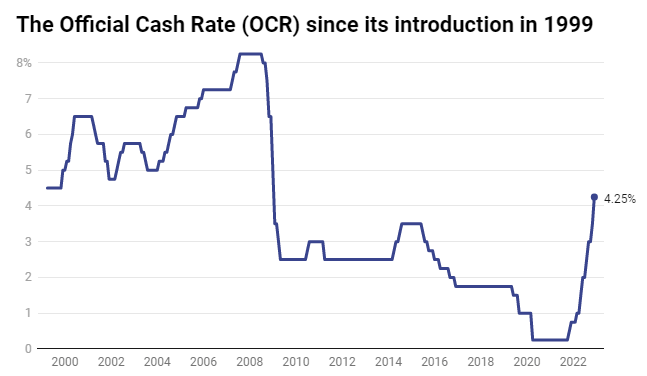

Today the Monetary Policy Committee increased the Official Cash Rate (OCR) by 75 basis points from 3.5 percent to 4.25 percent which lifts the OCR to its highest point since December 2008.

It’s the ninth OCR rise in the last 13 months making this the fastest period of increase since it was introduced.

Why Interest Rates Are Increasing

Borrowers are being penalised because Kiwis are continuing to spend!

The Reserve Bank have stressed that monetary conditions needed to continue to tighten further (interest rates increase more) so as to be confident there is sufficient restraint on spending to bring inflation back within its 1-3 percent per annum target range.

We know that food and energy prices have combined to create very high headline core inflation in many countries including New Zealand, but here we have other influences too including:

- Wage Increases – many sectors and particularly Government employees have had wage increases, and that fuels additional spending.

- Government Spending – we have seen a period of extraordinary Government spending, and there appears to be no restraint on this. It’s been highlighted as a major factor that has contributed to the high inflation, but there is also an election coming up which unfortunately will probably mean that this spending will continue. Other concerns are that much of this spending is using borrowed money and not targeted to anything that will create growth in the economy.

- Reserve Bank Mismanagement – it’s “almost” been admitted that the Reserve Bank managed the COVID crisis poorly by using new monetary policy tools to support maximum sustainable employment, and by doing so lost sight of their core role to maintain price stability and keep inflation within the 1-3 percent per annum target range.

In the past we have seen high inflation, but that has been due to having a good economy. This time the drivers are quite different as we have highlighted.

How High Will Interest Rates Go?

This is the question that everyone is asking.

Interest rates are being driven higher because of the high and ongoing inflation, and while this continues we are likely to see the Reserve Bank continue to push up the OCR. The Reserve Bank made a comment on how they observed that consumer price inflation in New Zealand in the September quarter was significantly stronger than expected and highlighted that the longer actual inflation remains above the target band, the more likely it is that higher inflation expectations become embedded.

While inflation remains high it is expected that the Reserve Bank will continue to increase the OCR as that is really the only tool available to them.

But what happens when the economy can no longer withstand the high interest rates?

What Happens When The Economy Collapses?

There are plenty of economists that are predicting that we are heading towards a recession, and that could change things.

Even the Reserve Bank has forecast a recession for mid-2023 which is not far away!

The latest forecasts paint a grim picture of four consecutive quarters of negative growth across June, September, December 2023 and March 2024 and with the exception of the brief lockdown slump of 2020, the last time New Zealand was in recession was during the Global Financial Crisis of 2009.

What is unknown is how deep and how long will this recession be?

Kiwis Generally “Hunker Down”

Our last major financial crisis was in 2007 – 2009 when the Global Financial Crisis impacted New Zealand.

This was different in the fact that the banks stopped lending and finance companies collapsed, but it was still a major event and was interesting to see how Kiwis dealt with their finances at that time.

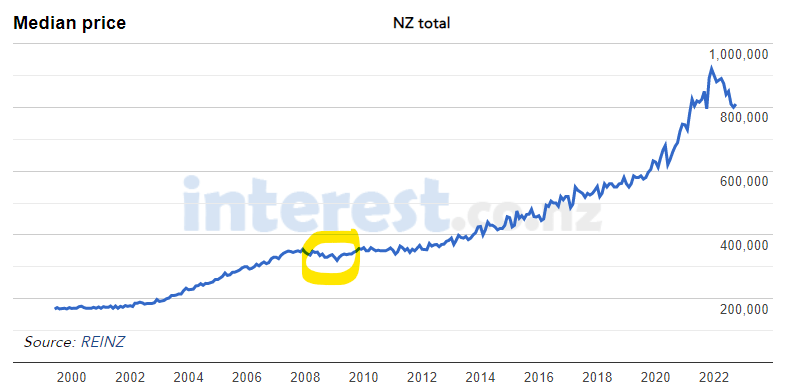

A few observations from the GFC was that Kiwis tended to lock things down and stopped spending, instead focusing hard on getting rid of debts. House values were hit because money was hard to get, and so anyone that needed a mortgage was going to struggle.

The Government and Reserve Bank helped by introducing tax cuts and lowering interest rates and by 2010 we were emerging from the GFC and entered a period of high economic growth. Housing growth followed and when you look back it’s hardly evident that there was such concern.

Very few Kiwis can still remember the Great Depression (1928 – 1933) and those that lived through it will want to forget it. The New Zealand that faced the Great Depression was a very different New Zealand compared to what we have today. It was a time where we were very reliant on farming and exports to the UK accounted for about 80%, so when the UK was hit hard we were so interlinked that we got hit as well.

At the time many farmers were heavily in debt and so banks called in loans, farmers walked off their farms and many small towns and businesses were hit hard too. Unemployment spiked to as high as 20% and there was very little in the way of a social welfare system. It wasn’t long until the cities were hit and the country spent 5-years in a very depressed state.

In previous times of financial crisis Kiwis have tended to hunker down and ride through until things improve, and that’s the good news … things will improve.

How To Manage With Higher Interest Rates

It’s all very well to understand the reasons that have caused the higher interest rates, but the real question is what can we do to buffer against the impact that these have on us.

We recently wrote an article called the six things to combat high home loan interest rates and that includes (1) fixing or refixing your home loans, (2) extending your loan term, (3) refinance your mortgage, (4) consolidate your short-term debts, (5) have a revolving credit account and (6) watch your spending. You can read this article HERE and see what of these may help you.

The other thing that we should all be considering is our income. If we had a higher income then we would not feel the same impact of the higher interest rates. But how can we earn more?

At the moment there is very low unemployment and plenty of vacancies for jobs. This creates opportunities for those of us that want to increase our income and we can:

- See if there is the opportunity to get a pay increase in our current role or with the current employer. If you are a valued employee then let your employer know that you need to find a way to earn more. They may be able to pay you more to retain you, or may be able to offer you some extra work.

- Find a part-time job. There are plenty of businesses looking for staff and a lot of those roles are available to people that want to work part-time and with little or no experience.

- Start a side hustle – there are a lot of opportunities to start a little part time business or to engage in a part-time role. This may be as simple as selling online or with Trade Me, starting a role that can be done online (there are a number of these) or creating a small business that might do lawns, washing cars, ironing etc.

Often having an extra income of even $200 a week will make all the difference.

We have previously written about how much help this is for first home buyers, but it is helpful for anyone really. You can read this article HERE and see if this may help you.