Buying a brand new home is a dream for many first-time buyers; however, the substantial deposit often required can make this dream appear out of reach.

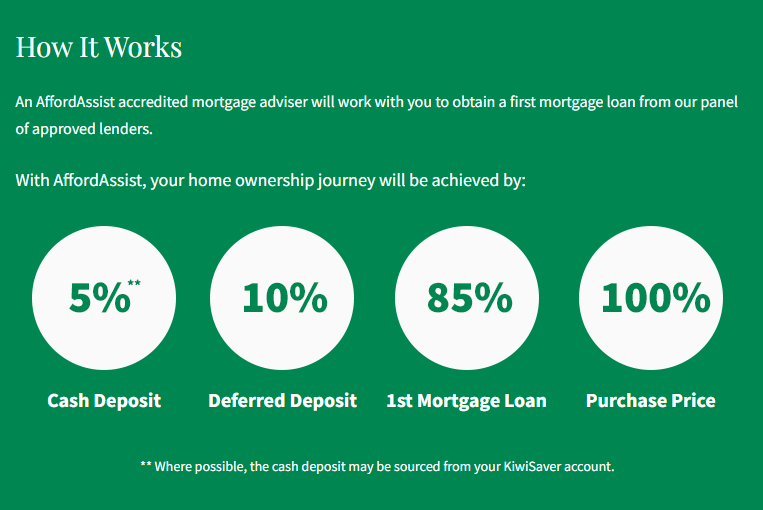

Enter AffordAssist, a game-changing programme that makes owning a brand new home more accessible with just a 5% deposit. This innovative approach not only lowers the financial barrier but also simplifies the entire home-buying process allowing more people to step onto the property ladder.

Ever wondered if there’s a way to own a brand new home without the hefty deposit traditionally required by lenders?

Key Takeaways

- AffordAssist offers a convenient route to home ownership with only a 5% deposit

- The programme reduces the initial financial burden (the deposit) for first-time buyers

- Buyers enjoy access to a selection of brand new homes

- The initiative opens doors

- AffordAssist empowers buyers to act swiftly and buy in the current market

Discover the Benefits of Buying with a Low Deposit

For many first-time buyers, entering the property market can feel like an uphill battle.

The traditional requirement of a hefty deposit can deter even the most determined individuals. However, buying with a low deposit offers a breath of fresh air, simplifying the path to home ownership.

With AffordAssist, you can sidestep the significant upfront deposit requirements and step into your dream home with just a 5% deposit.

First-time buyers often find themselves on the back foot, competing against seasoned investors. But with the AffordAssist programme, the playing field is levelled. You can now confidently enter the housing market without the need for sizeable savings. This low deposit option not only opens doors to brand new homes but also provides an opportunity to invest in your future.

The ease of buying with a low deposit cannot be understated. AffordAssist simplifies the home-buying process, reducing the initial financial burden and allowing you to focus on what’s important—securing your new home. This approach grants you financial flexibility, enabling you to allocate funds for other expenses or investments, thus enhancing your overall financial wellbeing.

Moreover, the low deposit requirement empowers more people to realise their dream of home ownership. It’s not just about buying a property; it’s about gaining the confidence and means to invest in your future. Whether you’re a first-time buyer or a property investor, AffordAssist offers a gateway to a promising future.

Exploring the 5% Deposit Solutions

Imagine a world where you can purchase a brand new home with just a 5% deposit.

Mortgage advisers have access to a few options, and at Mortgage Managers we have more than most with:

- Banks – yes they will typically ask for a deposit of 20% but at times can approve home loans with lower deposits

- Kainga Ora – this is a Government backed option where you can get home loans with 5% deposit, but you must meet the criteria. A lot of first home buyers are not able to access this option as they earn too much, have not been in the same role for long enough, may have had a credit issue and there are other reasons too.

- Non-Banks – generally will not lend above 80% – 90% but can often allow a small second mortgage to cover any shortfall. This can sometimes be an option that a mortgage adviser might suggest, although it can be expensive due to the short-term nature of these types of loans.

- Shared Home Ownership – is an option that first home buyers will often choose when they do not meet the criteria for the other options. It’s also a good option, but depending on how the values increase in the property market it can be more expensive as you share any capital gains with the shared home ownership partner.

- AffordAssist is another solution – it’s a unique programme tailored to meet the needs of modern home buyers. This innovative approach provides an alternative to traditional high-deposit requirements, making home ownership more accessible than ever before.

The AffordAssist programme is designed to ease the financial strain typically associated with buying a home. By offering a streamlined process, it reduces the complexities involved in securing a mortgage. This not only saves time but also decreases the stress levels often experienced by first-time buyers navigating the housing market.

With a 5% deposit option, you have access to a wider range of property choices. Whether you’re looking for a cosy flat or a spacious family home, the AffordAssist solution ensures you have the flexibility to choose a property that suits your lifestyle and budget. This broader selection opens up opportunities that might have previously been out of reach.

In a competitive market, timing is everything. The AffordAssist solution empowers you to act quickly, enabling you to secure a property before prices soar. This proactive approach ensures you’re always one step ahead, ready to seize opportunities as they arise.

Why First Home Buyers Are Choosing AffordAssist

First-time buyers are increasingly turning to AffordAssist for its appealing low deposit option.

The reduced financial barriers make owning a new home not just a possibility but a reality. This programme is particularly attractive to those with limited initial savings, offering a practical solution to the age-old problem of saving for a large deposit.

AffordAssist stands out in the crowded market due to its flexibility. The programme caters to beginner home buyers who wish to ease their way into property ownership. By lowering the financial hurdles, it allows buyers to get onto the property ladder before house prices rise further, ensuring they secure their investment at the right time.

Buyers know that AffordAssist provides successful outcomes. The programme’s track record speaks volumes, offering a reliable route to home ownership for countless individuals. It’s not just about buying a property; it’s about making a smart, informed choice that benefits you in the long run.

The Steps to Securing Your New Home with AffordAssist

Starting the journey to home ownership with AffordAssist is a straightforward process. It begins with assessing your financial situation with the guidance of a mortgage adviser. Understanding your budget and financial standing is crucial in determining your eligibility for the programme.

Once you have a clear picture of your finances, the next step involves completing the application process. This requires providing the necessary supporting documents to gain approval from both lenders and AffordAssist. This stage is crucial in paving the way for your home ownership journey.

With approvals in place, you can then review the selection of brand new homes available through AffordAssist. The programme offers a variety of options, ensuring you find a home that meets your needs and preferences. This step is all about exploring your choices and making an informed decision.

Finally, with all the necessary approvals and decisions made, you can secure your brand new home. This step marks the culmination of your efforts, bringing you closer to realising your dream of owning a home. The AffordAssist steps ensure a seamless and stress-free property purchase experience.

The Next Steps to a Bank Home Loan

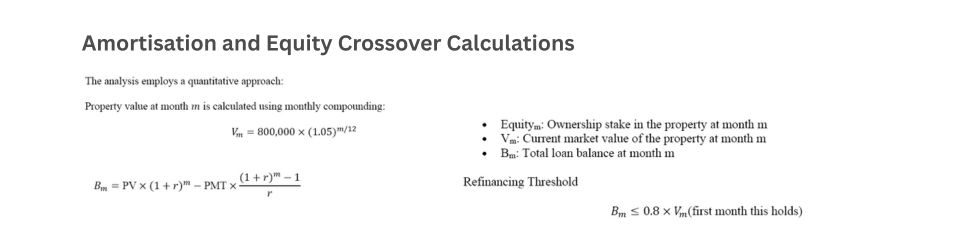

As house prices rise and lending through AffordAssist reduces your property’s equity will increase. This growth in equity is pivotal, as it opens up opportunities for refinancing your mortgage with a bank.

The AffordAssist is set up over a 5-year loan term; however if we assume a 5% capital gain and that your loan repayments are paid on time then in 25-months you would have 20% equity, and therefore it’s time to reassess your lending options – to refinance to a bank.

Engaging with a mortgage adviser at this stage is essential. They can guide you through the process of transitioning from your existing lender and AffordAssist to a bank home loan.

This involves finding the best home loan that suits your needs, ensuring you continue to manage your finances effectively.

Refinancing your mortgage with a bank offers several advantages – it not only provides competitive interest rates but also gives you the flexibility to pay off your home loan faster. This proactive approach to managing your mortgage ensures you’re always in control of your financial future.

Not All Mortgage Advisers Have Access to AffordAssist

As you might now know AffordAssist offers a revolutionary approach to home ownership, making it accessible to more people than ever before.

With just a 5% deposit, you can secure a brand new home and enjoy the numerous benefits of property ownership.

So, are you ready to take the plunge and explore the opportunities that AffordAssist has to offer?

By following the outlined steps and leveraging the benefits of AffordAssist, you can embark on a rewarding journey towards home ownership. Don’t let the traditional barriers hold you back—seize the opportunity and make your dream home a reality today.

Frequently Asked Questions

What is AffordAssist, and how does it work?

AffordAssist is a financial programme designed to help potential homeowners purchase a new property with just a 5% deposit. It offers a flexible payment plan that allows buyers to enter the property market sooner rather than later. By reducing the initial deposit requirement, AffordAssist makes homeownership more accessible for those who might otherwise struggle to save a larger sum.

Who is eligible to use AffordAssist’s services?

AffordAssist targets first-time buyers, though other eligible buyers may also benefit. Ideal candidates include individuals or families who have a stable income but find it difficult to save a substantial deposit. Eligibility criteria can vary, so it’s best to consult with AffordAssist to understand specific requirements.

How does a 5% deposit make buying a home easier?

A 5% deposit significantly lowers the financial barrier to entry for homeownership. Traditional mortgage lenders often require a 20% deposit, which can take years to save. With AffordAssist, you can fast-track your path to owning a home by reducing the upfront financial burden, making it more feasible to enter the property market sooner.

Are there any hidden costs or fees associated with AffordAssist?

AffordAssist strives to maintain transparency with its clients, clearly outlining any fees or costs involved. While there may be some administrative or service fees, these are typically communicated upfront. It’s always a good idea to review all terms and conditions carefully to fully understand any financial commitments.

How do I get started with AffordAssist?

To begin your journey with AffordAssist, visit their website or contact them directly for a consultation. They’ll guide you through the application process, assess your eligibility, and work with you to develop a tailored plan that suits your financial situation. This personalised approach ensures that you receive the best support on your path to homeownership.