We discuss three options available for buying your first home with just 5% deposit, and point out the criteria that might limit you and the additional costs that you need to be aware of. These options include:

- First Home Loans supported by Kainga Ora

- Bank Lending to 95% LVR

- Shared Home Ownership

There are pro’s and con’s with each method and also criteria that might mean that you are excluded from one of more of these options too, but the key role of a good mortgage adviser is to highlight what the options, explain what is possible and then you are in a better position to make some real decisions.

First Home Loans supported by Kainga Ora

The most popular option is the First Home Loans option, where Kainga Ora supports some of the banks (not all) and this means those banks can lend to you with a 5% deposit if you meet all of the eligibility criteria.

One of the critical pieces of that criteria is about the maximum income cap – to be eligible you cannot earn more than $150,000 per year as a couple.

In the larger cities where house prices are more expensive, that is a real impediment for people.

If you don’t earn more than $150,000 then it’s going to be a struggle to afford the average home in these areas, and yet if you have enough money to afford the home loan (over $150,000pa) then you are not eligible.

So, if you are deemed to earn too much, then the options of a low deposit of 5% become pretty limited.

Bank Lending to 95% LVR

At this stage we just have one bank that is actively promoting that they will provide this sort of finance, and that’s BNZ.

Of course, this does suit some people but it’s important to remember that they have strict criteria too. When you are borrowing from a bank they use a test rate to assess the level of lending that you can have, and then they add the low equity margin (premium) to that rate. With just a 5% deposit, or to borrow 95% BNZ charges a low equity margin of 1.20%, which is added to your interest rate and also added to the rate that the bank tests your affordability on.

If you have a large mortgage, the additional 1.2% adds up to quite a bit of money and increases the repayments substantially.

Shared Home Ownership

The other option that we do have is shared home ownership.

This is where we use a bank (SBS Bank) to fund 80% of the purchase, and a company like YouOwn to fund the other 15%.

This can be a more affordable option for a lot of people. The mortgage with SBS allows you to get some pretty good interest rates, with no equity margin attached. The 15% that you get from YouOwn has an equity fee equivalent to just 5.95%, plus $100 a month for administration.

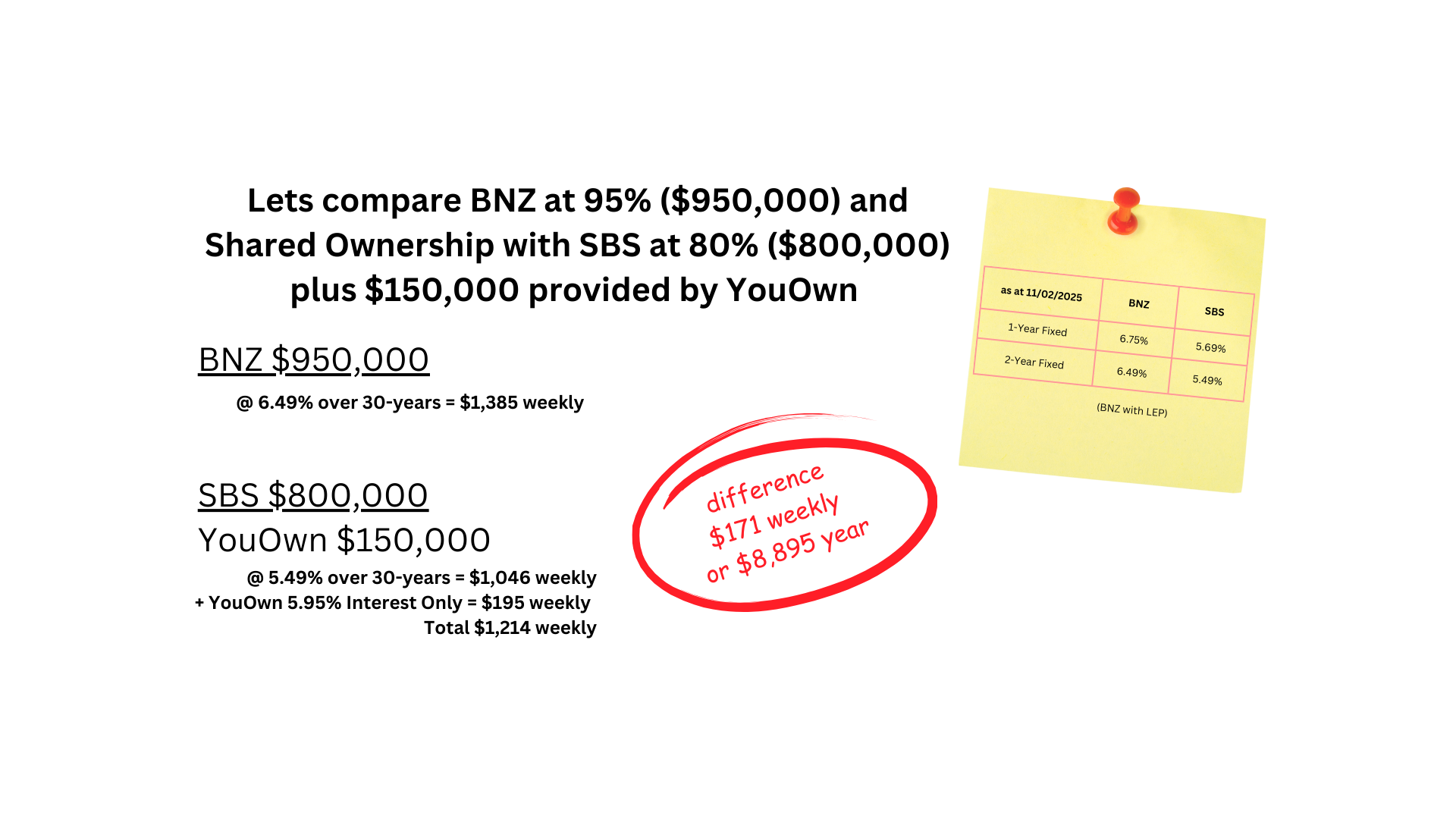

Let’s Compare BNZ & Shared Home Ownership

Let’s compare how a million-dollar property would look, using just a 5% deposit.

As you can see, the shared home ownership option is much more affordable when you consider what it’s costing you every week, or year.

BUT, what’s the catch with shared ownership?

Now, you might ask yourself what is the catch – there’s always a catch!

Using the example above – with shared ownership you along with the bank own 85% of the property, and YouOwn has the other 15%.

You have a contract with YouOwn that allows you to purchase their share (the 15%) back from them, but not until after 5 years.

You then purchase that 15% share back off them at the market value at the time that you purchased it. Let’s assume that the property increases in value over the next 5-years and is then worth $1,300,000 (an increase of $300,000) and we know that YouOwn originally contributed $150,000 (15%) of $1,000,000, and now when you purchase that share back off them, their 15% has increased in value by $45,000.

How Does This Compare Over 5-Years?

So, let’s look at what the difference in cost is.

As you can see, the shared home ownership option is more affordable in the short-term and that allows you to purchase a more expensive home and/or retain a better lifestyle over the next 5 years.

Using these numbers you are $8,895 per year better off so over 5-years that is $44,475, but there is a cost when you go to purchase that share back off them and for the example used that is $45,000

The net result for this example works out roughly the same.

Note: these are assumptions and things can change. Interest rates over 5-years may drop or increase, and the house value is likely to increase but by how much we do not know. Please do not take this as financial modelling – it’s an example only.

Get Advice First

The key thing with any purchase is to go in with your eyes open, so that you know exactly what you are signing up for.

Not everybody is going to be happy with the shared home ownership option, but it does very much fill a gap and makes home ownership affordable for a lot of people where otherwise buying a home was not really an option. It might help or even be the only option if you are buying your first home with just 5% deposit.

It also means that you can buy now at today’s prices, rather than continuing paying rent and trying to save., knowing that you may have to pay more when you are finally able to buy.

Using the numbers above if the house has increased from $1 million to $1.3 million, then that means you may have had to pay $300,000 more if you had stayed saving.

By having someone owning 15% of the home over the 5-years they benefit by $45,000, which is quite a lot of money, but more importantly you also benefit by $255,000.

So, what’s the next step?

The best idea is to talk to one of our advisers as we are specialists in this area and are accredited with YouOwn. We also have access to the lending with SBS Bank and a non-bank lender for those people that may have issues getting bank finance right now.

Shared home ownership is another way buying your first home with just 5% deposit, and it does suit a lot of people – it’s probably better than renting!