If you have reviewed your credit check and credit score and found it needs to improve, then you need to read this.

You want to improve your credit score and this is where we provide some tips that you can use.

How To Improve Your Credit Score

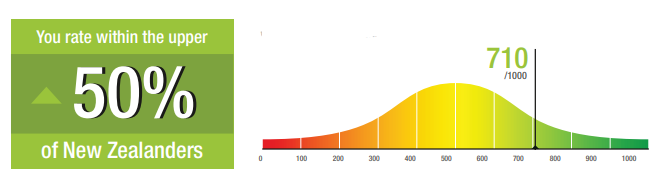

Your credit score goes up and down based on what you do with your money.

The credit agencies get a lot of data from the various lenders and also from companies that provide credit terms on telecommunications, streaming services and utilities electricity, gas) which includes if you pay your bills on time.

The exact calculations by which the final number is determined are private; however, different factors are weighted according to how much they affect the final score. You can apply some common sense to this – if you are paying late then the score goes down, but paying on time helps increase the score. Other factors also have a bearing including how often you shift address and how many enquiries are made on you.

If you have bad credit, a low credit score or if you have no credit history at all, there are actions you can take to improve your credit score.

Improve your credit score

- Make payments on time: this goes for loan repayments and bill payments.

- Pay your credit card in full: do this every month to build good credit score and it’s even a good idea to get a credit card with a low limit (‘say’ $500) and spend a little bit each month but then pay it in full straight away.

- Check your credit scores: You need to check all three credit reporting companies and make sure the information they have is accurate. Ask for any errors to be fixed. If you are turned down for a loan, check your credit history and fix any errors before applying for more loans. (See credit reporting company details and how to fix errors in your credit report below.)

- Don’t share bills: Make sure your name isn’t on any bills with other people, eg if you live with flatmates and the power bill has all of your names on it, your credit score could drop if your flatmates don’t pay the bills.

- Limit credit applications: Every time you apply for credit, the lender will do a credit check and each check negatively impacts your score; therefore only apply for credit when you really need it.

- Limit payday loans and quick finance options: seeing these on your credit history can make lenders think you aren’t good with money.

- Cancel unused credit cards and accounts: multiple sources of credit don’t look good on your credit history. If your credit card/store card isn’t getting used, cancel it

- Wait for the time limits: Items on your credit history stick around for a set amount of time, four to five years. If you want to apply for new credit, wait until the old history disappears off your credit report, if possible.

Negative impacts to your credit score

- Missed payments: This can be everything from loans to bill payments.

- Defaulting on payments: A default is where a payment over $125 is overdue by more than 30 days and the lender has tried to recover the money. This stays on your credit record even if you repay the amount in full.

- Insolvency: Filing for one of the three types of insolvency — debt repayment plan (also called summary instalment orders), no-asset procedure or bankruptcy.

- Applying for too much credit: Applying for multiple sources of credit in a short space of time, eg applying for four credit cards in three months.

- Multiple credit checks: Many agencies/organisations checking your credit score shows you may be seeking more loans or credit than you can afford.

- Credit transfers: Shifting debt from one credit card to another.

- Debt collections: You owe money and your debt has been passed on to a debt collector.

- Hardship applications: If you applied for hardship with a previous loan, eg repayment holiday.

- Payday loan and quick finance applications: With their high interest rates, other lenders may consider these a last resort.

- No credit: Having no credit history means there’s no way for future lenders to see if you are a risk or not. This can have the same negative impact as having bad credit.

Time Limits For Credit History

There are time limits for how long particular entries stay on your credit history.

The Credit Reporting Privacy Code 2004 sets out how long certain information can remain on your credit file, including the following:

| Credit application information | 5 years from date of application |

| Payment default information | 5 years from date of default |

| Judgment information | 5 years from date of judgment |

| Bankruptcy | 4 years from date of discharge from bankruptcy |

| No asset procedure | 4 years from date of discharge from no asset procedure |

| Multiple insolvency events (as provided in the Insolvency Act 2006, s.449A) | Indefinitely |

| Previous enquiry record | 4 years from date of enquiry |

| Serious credit infringement information | 5 years from date of report |

Note: Even if defaults are paid they will still show on your report (as paid) for 5-years.

How To Dispute Information On Your Credit Check

Your first step should be to the credit agency that supplied the report.

You can read more here: Consumer Protection

Getting A Home Loan With A Low Credit Score

Often the banks will decline a mortgage application due to a low credit score or bad credit, and that can be frustrating when we know that adverse credit can stick on your report for up to 5-years.

You might not want to wait – sometimes there are good reasons to buy now or refinance now, and therefore you will want to know what options are available.

That’s where having a good mortgage adviser can really make a difference.

We know this can be the case, and for this reason we have a few banks and a number of non-bank lenders that we can consider even where the credit is not great.