So the good news is interest rates are coming down and therefore when you refix your mortgage you could be paying less, but dropping interest rates also present a great opportunity for you.

If you have been affording the payments okay, instead of just dropping to the lower repayments to give yourself a little bit more spending cash, what if you kept the repayments at the same level?

Ultimately, most homeowners want to be debt-free. Just imagine how much different your life would be if you didn’t have to make a repayment on your mortgage.

The only way to achieve that is to either win the lotto or start working on a strategy to pay your mortgage off faster.

At Mortgage Managers we suggest to all our clients to round up the repayments a bit and focus on paying your mortgage off faster. You may be surprised how those little extra bits on your mortgage do make a huge dent and ensure that you get freehold years earlier.

Let us explain why that is.

Round Up Your Repayments

Just as an example, if you have a mortgage of say $500,000, then for a standard 30-year mortgage over 30-years your repayments might be about $1,460 a fortnight. Of that repayment amount the majority is interest, and a little bit is used to pay down the mortgage – of the $1,460 that you pay $1,250 is interest, leaving just $210 that goes towards paying off your mortgage.

So if you were to round up your repayment up by $140 to $1,600 a fortnight that is actually increasing what you’re paying off your mortgage by 66% with every extra dollar that you pay over and above the interest is paying off your mortgage

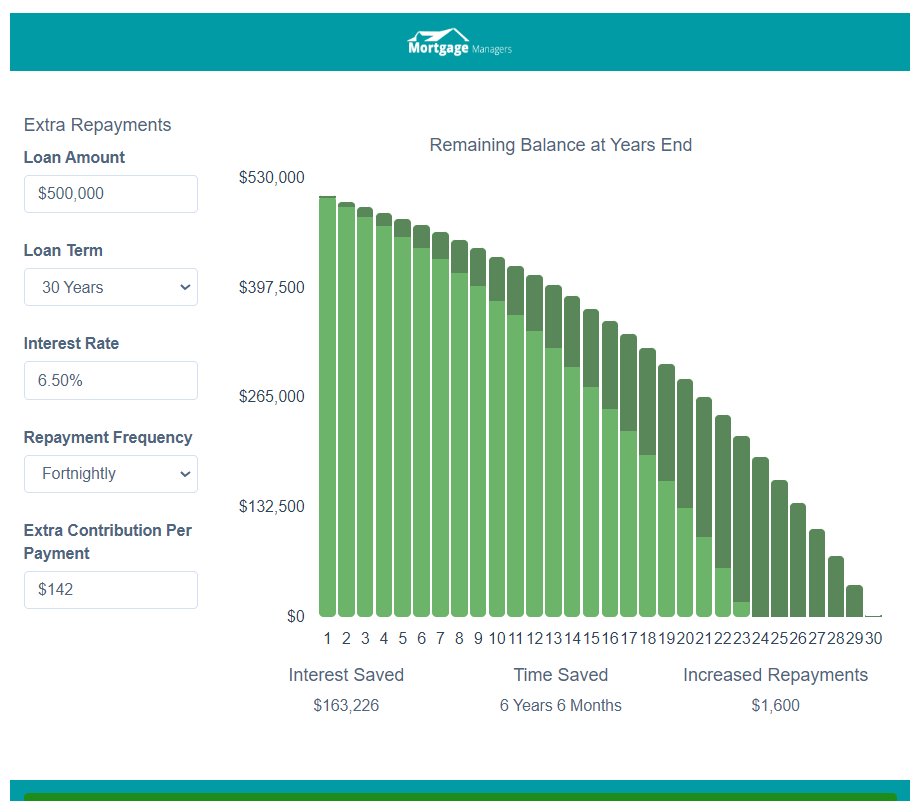

The graph below shows how much of a difference this extra amount can make to your mortgage.

As noted above, the extra $140 a fortnight will mean that you save over $160,0000 and can have your mortgage paid off 6½-years sooner!

That’s huge – imagine having an extra 6½-years with no mortgage to pay.

Remember, as time goes on and the longer you’re paying extra, the bigger that effect becomes. That’s because you’re paying less and less interest and more goes towards paying the principal and the effect can be the same (or similar) if you can pay a small lump sum off your mortgage but then keep your repayments the same.

So what do you need to be thinking about when you refix your mortgage?

Well, the first thing you should consider is: do you have your mortgage with the right bank?

The difference between the mortgages with various banks is quite significant. With some banks you’re restricted by what extra money you can pay towards your mortgage and that means it’s harder for you to pay the mortgage off faster and harder for you to save money. Of course, the banks don’t really want you to pay the mortgage off faster as while you’re saving money on your mortgage, that’s coming straight off the profit to that bank.

So the first thing you need to do is consider if you have the right home loan.

You Want The Right Home Loan

What is the right home loan?

As mortgage adviser the team are aware of all the options and can help you decide what will be best for you.

Consider things like the features of the mortgage and the types of loans available.

Have you considered a revolving credit mortgage? These can be extremely helpful in a lot of situations, as you can apply money to the mortgage like an overdraft, but draw it back if you need it later. The key here is you only pay interest on the outstanding balance on any particular day. It’s calculated daily. So that means if you can apply money to the mortgage account, and even if it sits there for five days, you have saved interest on that. The cumulative effect of doing this can be huge. But there’s also the risk with revolving credit mortgages, like overdrafts, that you never reduce it far from the limit. Because it’s a floating interest rate, which is higher, that is a problem if you can’t manage it properly.

Another type of loan that is getting increasingly popular is the offset loan. The key here is you can link a number of savings accounts to your mortgage, and you only pay interest on the net difference. How that works in practice is you might have a $20,000 offset loan as part of your mortgage. But if you have three different bank accounts with a total of $14,000 in savings, then you will only pay interest on the $6,000, being the difference between the offset mortgage and your savings. This works exceptionally well for people that like to have different bank accounts for different savings projects, where you might have a savings account for a holiday or a wedding where typically they would be earning low interest, which is then also taxed. So it makes sense to instead have an offset against your home loan, where you’re saving a larger amount of interest without paying tax. Unfortunately, offset home loans are only available from a limited number of banks at this stage, but definitely worth considering.

For most people, the majority of their lending will be structured on a fixed home loan or split across a number of fixed home loans, which is more popular and the recommended way to do things. Fixed home loans have lower interest rates, and you also have certainty on what your repayment is. You have certainty because your interest rate is fixed for a period of time, and therefore the bank can calculate exactly what your repayment needs to be for that particular loan until it comes off fixed. With the fixed home loan repayments, you’re almost certainly going to have an odd number as a repayment. But unfortunately, most people leave that repayment as it is, which is the minimum repayment to pay the loan off over the longest possible term. Even if you do nothing else, you should at least round up that repayment a little bit, because every extra dollar is going to pay principal off, and it will make a difference to how much you pay over the life of your loan. Most banks allow you to pay some extra on your mortgage so that you can round this up, but the bank policy on this varies significantly between the banks, and they are bad at promoting the ability to pay extra, of course. So what you need to know is what your bank will allow, or you need to shift to a bank that has the most flexibility. You want to be able to increase your repayments when you have extra cash available, but decrease them should times get tough. Over the years of having a mortgage, there will be times that get tough. Nothing is surer. Interest rates can go up again and put pressure on your finances, or you may change jobs or have some extra expenses like health care within the family. There are a number of reasons that you could be under financial pressure, so you need to ensure that you have the flexibility to reduce your payments to the minimum should that be needed.

Unfortunately, most banks would require you to reapply at that time, and of course, at that time when you want lower repayments your statement of position is not going to look that great.

Don’t get stuck in that trap.

So what should a mortgage review look like?

Of course, you’re always going to want to get the best possible interest rate you can, but you need to be mindful that the best rate today may not be the best rate tomorrow. As mortgage advisors, we always focus on getting a competitive rate, but making sure that you are with the bank that can offer you the mortgage structure that is going to suit you best.

You need to consider what bank you’re with and whether it’s worth changing. It’s actually easier to change than most people believe, and probably the banks try to make it sound as though it’s harder than it actually is. There is a cost to changing banks with your solicitor needing to be paid, but in most cases, we can negotiate some cash from the new bank you’re moving to that will help to cover those costs, plus it.

Talk To You Mortgage Adviser

When you talk to Mortgage Managers we can quickly assess what options you have including letting you know whether you’re with the right bank already (and therefore just need to make some tweaks to what you’re doing) or whether there is a better option out there for you.

It’s up to you – take this opportunity of the dropping interest rates and review what you’re doing – to make sure that you don’t spend the next few years paying more than you really need to.

We hope this has been helpful, and we look forward to talking to you and helping you in the future.