Don’t join the thousands of Kiwi’s that choose a home loan that can trap them.

You might have heard about people that have ended up in financial trouble with their mortgages and wondered how that has happened. Surely they must have been able to afford the loan repayments when they took the mortgage out, so what has changed and caused them to have financial difficulties?

Many of the people that get into financial difficulties are just like you and me – they are hardworking Kiwis that just want to provide a nice home for their families. So how do they end up getting into these financial difficulties?

Have they done something stupid?

We have seen many cases where people have been very good at paying their home loans, but ended up trapped. Without knowing it they have ended up with the wrong home loan.

How Did They Choose A Home Loan?

Some of these people have said they just went to the bank that they banked with and think that that’s an okay way to arrange a home loan. The person at the bank is not going to tell them the pitfalls and why you should go down the road to another bank and use their home loan instead. The person at the bank doesn’t give advice like that, and unfortunately even a lot of mortgage advisors don’t give that advice either.

Possibly because most mortgage advisers in New Zealand used to work for a bank and were trained in the same way that banks train their staff. Or possibly it’s just that they are too new to the industry – they haven’t yet had to unwind some of these disasters that people have found themselves in.

How Kiwi’s Get Trapped

Let me explain how so many Kiwi’s get trapped with their home loans.

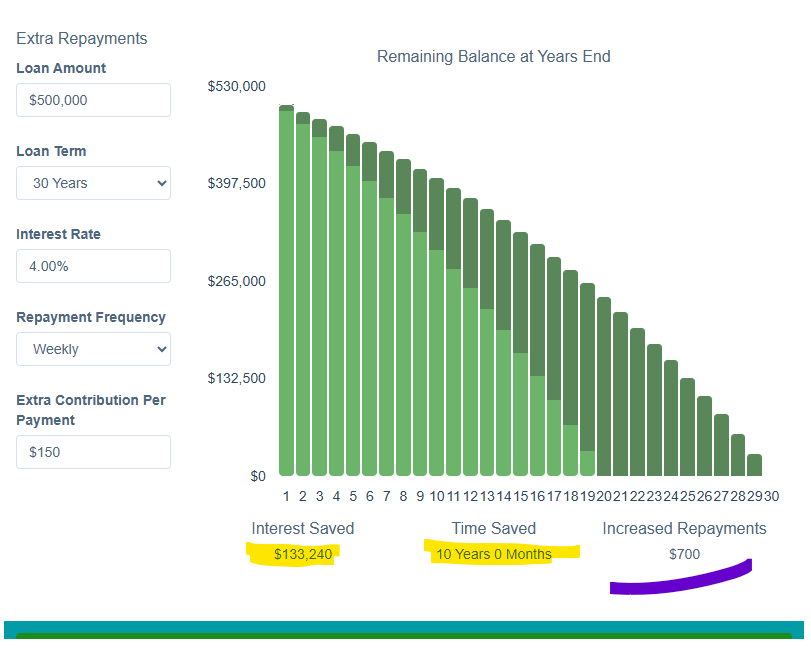

So let’s consider this: you have a $500,000 mortgage and you’re paying 6%, which is around $700 per week. The mortgage comes off fixed, and you can refix that mortgage now at 4% which would reduce your repayments to $550 a week. But you decide to do the right thing and pay the same $700 a week.

The mortgage adviser or the person at the bank can show you that this would cut 10 years off your mortgage, potentially saving you $130,000 or more – so it seems like a really sensible option!

Now, that would be a sensible option with some home loans because you can have the ability to pay the mortgage off faster but not shorten the loan term.

The problem is, if you shorten the loan term and the interest rate then pops back up to 6%, you’re stuck on a 20-year loan term, and those repayments jump up to $825 a week.

Can you afford that sort of increase in repayments?

What if the interest rates increased to 7%, then you’re talking around $900 a week.

Now this is not some fantasy; this happens quite often, and we’ve seen that over the past few years on a number of occasions. People have ended up in a really difficult financial situation because they thought they were doing the right thing but they did not speak to somebody that could explain the implications of these decisions with the home loan that they had.

As mentioned, it makes sense to pay your mortgage off faster and the savings can be very significant BUT you need to understand how your home loan works, or know how to choose a home loan that works better so you do not fall into this trap.

Get Good Advice Before You Change Anything

We know that Kiwi’s have a real ‘do it yourself’ attitude and that’s great with some things.

When you are dealing with your largest financial commitment (your home loan) then you probably should reach out for some good professional advice, and with businesses like Mortgage Managers that advice is offered at no charge to you so there is really no excuse not to at least have a conversation about the options.

You could go to the bank directly, getting no advice and knowing that you will not get any real comparisons. But why would you when you can also speak to a professional mortgage adviser and not pay a cent.

So many people we talk to think that mortgages, think that all home loans are the same, and the only real difference is what interest rate you can get. They’re often shocked when they learn how different some loans are. It’s then often a shock when they hear about a better home loan and think how much better financially they could have been today if they had had that better home loan for the last few years.

I recently had a client switch home loans after being with the same bank for over 20 years. They'd been with the same bank for all of their working life and believed that they were getting looked after because of the special deal the bank gave to people in their profession. They were pretty shocked to learn what they could have done differently if they'd had the right home loan.

Stuart Wills - Mortgage Adviser

Mortgage Managers spend a lot of time researching the differences in the loans to make sure that when you want to pay the mortgage off faster, you’re not going to get trapped into a situation that puts you into financial difficulty. We know that it’s hard to know how to choose a home loan and also we know lots of people think the only difference if the interest rate.

It’s one of the reasons to use a mortgage adviser for both arranging your home loan and then managing your home loan.

So now I would ask you – how do you choose a home loan?