Having a good flatmate or boarder can provide both company and a few extra dollars.

Personally when I purchased my first home I had four flatmates just so I could pay the mortgage, but we also had a lot of fun.

Now as a mortgage broker we will often talk with people about having a flatmate or boarder to help with both acquiring a home and paying the mortgage off faster.

Is It Worth It?

Of course it is nice to have your home to yourself and not have to worry about someone else living in your space.

But sometimes you need to consider the bigger picture … the financial benefits.

How it works for Caroline

I have been working with Caroline who is buying a home after separating from her partner.

She has a good size deposit, but will still end up with a mortgage of $350,000 which she would like to reduce and pay off faster.

Before I met with Caroline she had already thought about getting a boarder as she was planning to buy a house which had spare rooms and a friend had already shown an interest.

In this case it was very good as the extra income (boarder income) helped with the mortgage application, but also the extra income will help pay the mortgage off much faster.

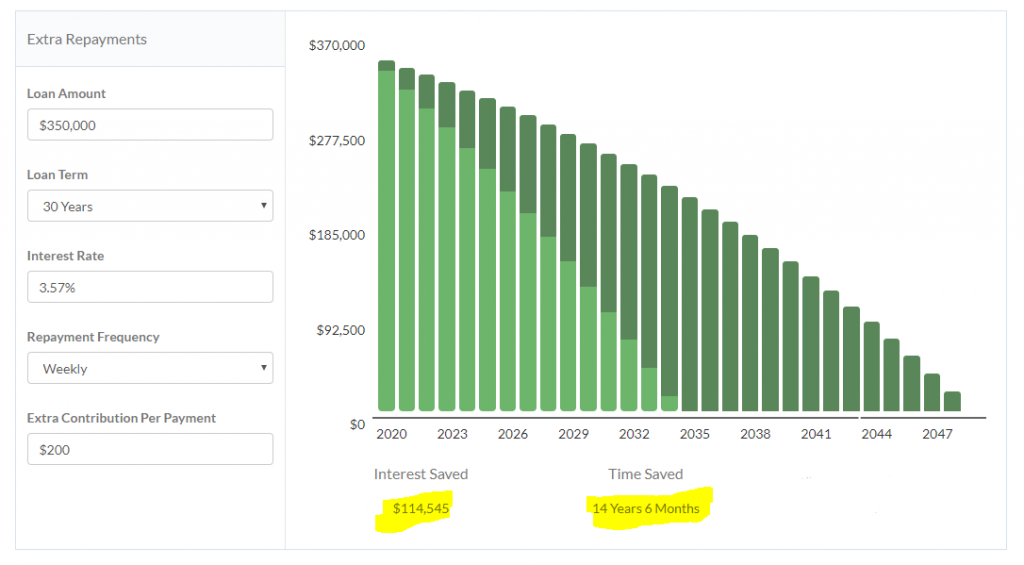

The agreement with her boarder is for $250 per week and Caroline decided to use $200 of this to pay her mortgage off faster – and the benefit of doing that is huge!

The extra $200 per week will cut the term of the mortgage in half … from a 30-year mortgage to 14-years and 6-months.

More importantly it will save Caroline $114,545

So is it worth having a boarder?

I think you would agree that it is for Caroline, but every situation will a little be different.

If you have the space available then it is definitely something that you should consider.

After all, it makes sense to pay your mortgage off faster if you can.

How Much Should You Charge?

This will vary a lot depending on location, the space available and what facilities you have.

This will vary a lot depending on location, the space available and what facilities you have.

You will be sharing your home with your flatmate or boarder so while the amount of rent is important it should be just one consideration. Often you might feel more comfortable charging a little less if you think it will be easy to live together. Maybe your flatmate or boarder may work shift-work or travel with work so they are not always there and this may be something that you prefer…

The easiest place to research what you should charge is Trade Me.

You can view a range of advertisements for flatmates and use this as the basis for setting the weekly rent that you will charge.

When you do seek a flatmate or boarder you need to be specific about things like smoking, pets, the way house expenses are shared, how you manage food costs and if they are able to have a partner stay or how this is handled. It’s best to address any possible issues right at the start and to document them within a written agreement.

You Should Have An Agreement?

Yes, it is important to have an agreement with any flatmate or boarder and it is recommended to have the payment directly into your bank account too.

The agreement that we recommend is a simple agreement that was made available by Tenancy Services and you can DOWNLOAD HERE.

Agreements for flatting or boarding are not covered by Tenancy Services.

Having an agreement can help avoid any disputes, but should you have a dispute then it should be handled by the Disputes Tribunal.

A mortgage broker may also require a copy of the agreement when applying for your mortgage.

Do You Need To Pay Tax On Boarder Income?

You should always consider any income that you earn as taxable; however you are able to offset costs against that income.

In the case of income being received from flatmates and boarders it is usually not taxed and does not have to be accounted for on your tax return. That is because the Inland Revenue Department allow you to apply a weekly standard cost amount of $270 for the first two boarders, so if you are charging $270 or less then you are deemed not to be making any money.

Please make your own enquires and decide what to do in your situation as this is not tax advice.

READ MORE on the Inland Revenue Department website.

They also have a CALCULATOR which you can use to see if you should file a tax return.

Renting out a room on a short-stay basis is a little different and there are other considerations.

Can Having Boarders Affect My Council Rates?

Having a boarder or flatmate should definitely not affect your rates; however various Council’s have been looking at those people that regularly rent out rooms on a short-term basis.

Renting accommodation through websites such as Airbnb and Bookabach is competing with commercial operators (hotels, motels etc). Auckland Council has introduced Accommodation Provider Targeted Rates (APTR) for anyone that rents out their property online for more than 28 days each year.

If you are considering renting your property or a room through websites such as Airbnb and Bookabach then you should check how your local council treats this.