As mortgage advisers we are often contacted by property investors who struggle to understand how the banks assess their loan applications.

To the property investor the property looks like a good investment, and yet the bank are saying they cannot afford the repayments.

It often defies logic, but that is how the banks assess things and it can be extra hard on property investors.

The Difference Between An Investor’s & Bank’s Assessment

We recently had a situation where a property investor approached us in a state of real frustration.

They had been dealing with the bank, and kept hitting a brick wall!

They had a good property and with their equity (deposit).

It meant the property was paying it’s own way (cashflow positive) but the bank kept saying that they could not afford it.

They had been affording it easily the way it was and tried explaining this to the banker.

When we spoke with them we had to explain that the banks look at things a bit differently, and with a very negative (conservative) set of glasses on. It was not that there was anything wrong with the property, but it was more about the way that the banks looked at the numbers.

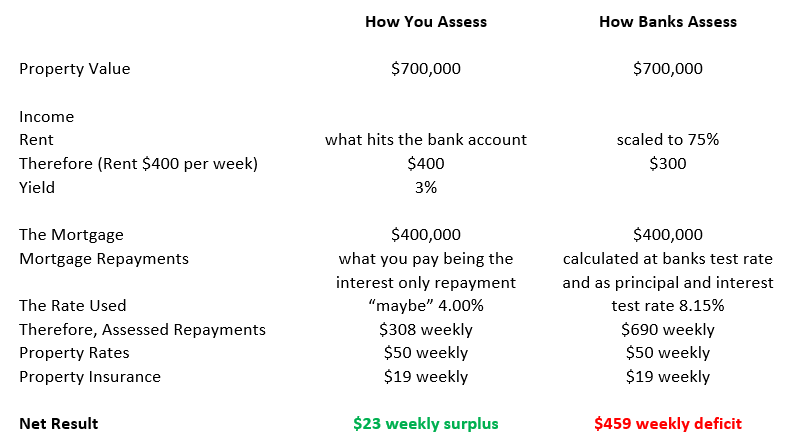

In summary, this is how the investor views things versus the bank:

There are some key things that make a huge difference.

You would assume that the assessment would be closer to what you actually would have, but banks can take a very negative approach to this and they:

- Scale your rental income

- Use a high test rate (interest rate) when calculating the test repayments

- Test on a principal and interest loan, not an interest only which is what most investors choose to use

They make it too hard for property investors who want to get a few properties.

In the past there have been some banks that have really suited property investors better than others; however in more recent times the banks have all been applying criteria that is similar so to maximise the borrowing potential it often means looking at the non-bank options.

What’s Your Property Investment Strategy?

Often people just fall into becoming property investors, or are “sold” the concept by one of the companies that promote property investment. Other people are looking for a way to leverage off their equity to build a retirement plan using property and as advisers we have helped many people secure their futures in this way.

When you start investing in property, or want to add an extra property then you may find that the way banks assess things is hard on property investors.

In many cases the bank will suggest that you can borrow enough for one or two properties, but beyond this it can get very hard. Banks also link the properties together, so they have control over all of your property assets and lending too. You need to be careful in how you allow the banks to control this, and generally we would suggest that you split your properties and split your lending across banks or lenders so you retain total control.

Contact one of our team and we will help you set up a good property investment strategy.