Do you want lower home loan rates?

We have heard the banks economists predicting increases in home loan rates and most people accept this is a trend for 2017; however regardless what the banks say, as home owners we all want lower home loan rates, or at least as low as we can get.

A home is one of our biggest assets and the home loan is typically one of our biggest debts, and so the loan repayments will be a significant part of our household budget. If we can get lower mortgages rates it helps and leaves more money for other things, or allows us to pay off our mortgage faster.

But how do you know if your bank is going to offer you the best rate?

Get The Lower Home Loan Rates

You already have a home loan with one of the banks and it’s about to come off a fixed rate. The bank send you a letter to explain this and you can either refix your loan on the rate offered or leave it in which case it goes onto the banks floating rate.

Generally the fixed rates are lower and your strategy has been to keep on the lower fixed rates.

There are three ways to refix your mortgage;

- You accept the fixed rate offered in the letter from your bank

- You contact the bank and negotiate a lower home loan rate

- You contact a mortgage broker to negotiate the lowest home loan rates on your behalf

The banks know that in most cases they can get away without offering you the lowest fixed rate mortgages and so they don’t, but they also know that a good mortgage broker knows what all the banks are prepared to offer and therefore they cannot get away with offering uncompetitive mortgage rates.

Don’t Accept The Advertised Mortgage Rates

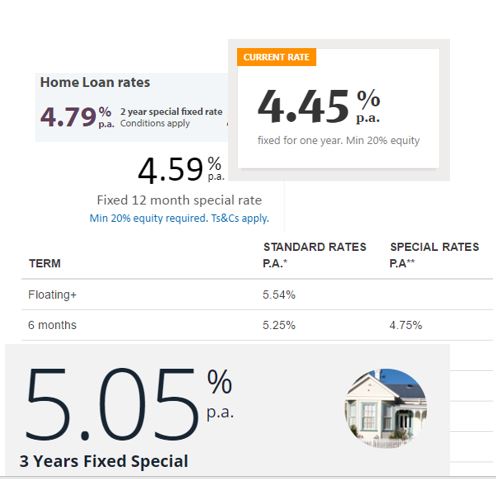

The banks all have the standard home loan interest rates that they advertise on their websites.

These rates might be advertised as “special rates” but that does not mean the bank cannot offer you lower rates still.

As mortgage advisers we typically base our mortgage strategy around taking advantage of fixed rate loans and spliting the mortgage into more than one loan helps protect you against sudden interest rate increases.

Property Investors Want Lower Rates Too

A property investor might want to fix at the 5-year fixed rate, but why would they accept the rate that ANZ is offering when they can get a lot lower fixed rate from ASB and that is without even trying to negotiate.

Even the non-bank lenders like Resimac Home Loans offer a lower 5-year fixed rate of 5.67% and they are not bound by the LVR criteria that applies to property investors. A non-bank lender like Resimac Home Loans can still offer property investors loans of up to 80% through a network of selected mortgage brokers and Stuart Wills is one of thosebrokers that have access to these loans.

Some People Need Specialist Home Loans

There are situations where people cannot get the normal home loans offered by banks and instead need to look at specialist home loans offered by some of the non-bank lenders. Of course situations differ and at times people will not fit the standard criteria that banks use. It does not mean that those people should be left with no choices and brokers at The Mortgage Supply Company have a range of options and the expertise to get the best home loan rates and options available.

The rates offered by non-bank or specialist lenders are not as low as some banks offer, but they act as a place to get a home loan when otherwise this might not be possible.

A good mortgage broker will get you lower home loan rates