Yes, you can and should review your home loan now.

What do we mean… don’t wait until your fixed term ends.

Most people will have their home loan fixed and will wait for the fixed term to be ending before they refix.

Honestly, most people wait for the bank to contact them with the interest rates that they can offer and they refix then and at the rates given.

You Can Review Your Home Loan Now

As mortgage brokers a big part of our role is to keep banks honest and that often means reviewing home loans to see if they are as good as they can be.

It’s easy to fix your home loan and forget about it until the bank let you know that it’s due to be refixed again.

But as we have seen over the past few years the interest rates vary a lot.

Home loan rates are very low now compared to what they have been – they are at record low rates!

This means that if you have fixed home loans then you may be paying more than you would if you refixed today.

But of course the banks have you locked into a fixed rate and will charge you a break fee if you want to exit the fixed term earlier and take advantage of the lower rates.

Well that’s what everyone thinks…

We Reviewed Clint’s Home Loan

We Reviewed Clint’s Home Loan

This week we were reviewing some things with a long-time client named Clint.

He has his mortgage split into two fixed rate loans and one was due to come off the fixed rate.

So the one loan was easy – it had come off a 2-year fixed rate of 4.89% and we could refix that again for another 2-years at a far lower rate of 3.89%. The loan was for about $135,000 and they had been paying just over $780 monthly on this loan, so the lower interest rate also meant the loan repayments could reduce to just under $705 monthly – a saving of $75 a month which is a 10% saving.

But we also looked at his other loan – this was still fixed at 4.59% for another 6-months so Client assumed that we had to wait until December. That assumption might be what the banks want people to think, but we decided to check what the break fee would be on this loan too.

The break fee was just $20!

It obviously made sense to refix this loan at the lower rates too.

By paying the $20 Clint could reduce the interest rate to 3.88% (fixed for 1-year) and therefore reduce the repayments on this loan of about $135,000 by $55 a month from about $760 monthly to just under $705 monthly. Over the 6-months remaining that’s a saving of $330, or $310 after the $20 break fee is deducted.

But Wait … There’s More

Sorry, no free knives but … Clint is keen to pay his mortgage off faster so we explained the opportunity to him.

By refixing his loans he had cut his monthly repayments by $130 a month.

What is he keeps the repayments the same?

We did some calculations for Clint;

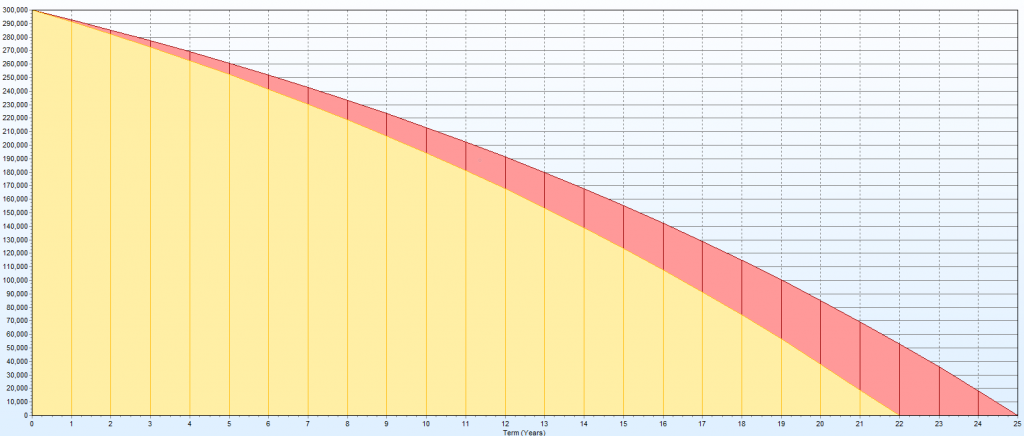

If he keep the repayments the same then he would cut the term of his mortgage by 3-years

More importantly he would save over $23,000

This is a simple way to pay your mortgage off faster without even noticing the difference.

You really should contact a mortgage broker and see what you could do with your home loan.

You could take a small bite out of your home loan, or get serious and implement a mortgage reduction plan.

We do say there is no better time … review your home loan right now.