Of course everyone wants the cheapest home loan rates.

Frankly I would too; however we need to be careful when we focus solely on getting the cheapest of ‘anything’ and with a home loan being such a major financial commitment we want to ensure that we do not make mistakes.

So Who Offers The Cheapest Home Loan Rates?

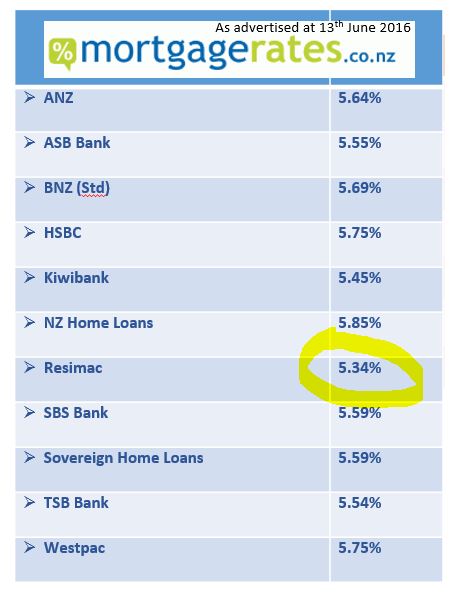

Most people think that it would be one of the big banks that offers the cheapest home loan rates in New Zealand so you might be surprised to see this;

Resimac Home Loans is a not even a bank and they are offering the cheapest home loan rate, or at least the cheapest advertised floating home loan rates.

Should Everyone Refinance To Resimac Home Loans?

If they have the cheapest home loan rate and that was the sole criteria for being the best option then you would expect that everyone would be wanting to refinance their mortgage to Resimac Home Loans, but this is not the case.

The banks and non-bank lenders are all competing for business and they have tended to compete on interest rates which has become the focus for many people. The interesting thing is of the lenders listed on the table, NZ Home Loans are the most expensive and yet they promote themselves as debt reduction specialists.

- Yes, the interest rate is important but there is more to a home loan that just the rate.

What Makes A Good Home Loan

A good home loan needs to be structured correctly so that it matches with your lifestyle, with your immediate and longer term goals and ideally it needs to be structured so you can pay it off much sooner than the banks want.

Most of the time this means that your home loan will be split between more than just one loan and an experienced mortgage advisers like the team at The Mortgage Supply Company will offer this free advice as part of arranging a new home loan for you, or even if you already have a home loan and are looking for a professional opinion with a review.

Everyone wants the cheapest home loan rates too and while you may not always be able to get the cheapest rate for all of your loans, but the interest rates do need to be part of the decision when you select banks.