Shared home ownership has become more popular in New Zealand but there is still a lot of people that have not considered it as an option for them, and maybe there is a lack of knowledge about how shared home ownership works.

For that reason we thought we would write a post explaining a bit about the concept and how shared home ownership works for first home buyers.

How does shared home ownership work?

Shared home ownership allows people to partner with another party (person or entity) to buy a home. Generally this concept is used when there is either not enough deposit or the income will not support a large enough mortgage. At a later time you can buy the share back off the other party to get full ownership of your home.

In this post we will explain how the concept known as shared home ownership works and also point out the pro’s and con’s. This is not designed to “sell” the concept to you, but to ensure that you are informed about this option which will allow you to make your own decision.

What Is Shared Home Ownership?

If you’ve never explored shared ownership before it might seem quite complicated, but it is really quite a simple concept.

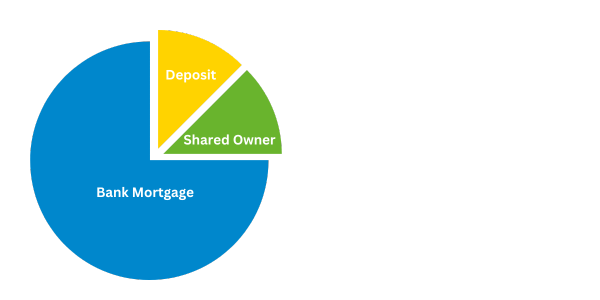

Obviously you will have a deposit to put into the purchase of your home. The bank may be willing to give you a mortgage, but it may not be enough.

How do you make up the shortfall?

You may have family that can help out, but for many people that is just not an option and that’s where shared home ownership can help.

You have someone that can share a portion of the home ownership with you.

In most cases that we’ve seen the buyers along with the bank are able to fund most of the purchase and so it’s just a small portion that they need help with – generally between 5% to 15% of the purchase price.

Who Shares The Ownership With You?

As mentioned, in many cases it is family (often parents) that are able to help but this is not going to work for a lot of people and so there are other options including Government programmes and specialist businesses. The three main options that are available are:

- Kainga Ora – First Home Partner which is the Government shared home ownership programme. It’s a very good option and the most cost effective; however there are restrictions especially regarding the income caps. Update – Due to recent unprecedented demand, this scheme is now fully subscribed and therefore we are unable to accept any new applications.

- YouOwn is a specialist in this area and has no income cap, but there is an equity charge for the use of the money. The equity charge works in a similar way to interest and means there is a monthly cost payable to YouOwn, and this needs to be factored in when applying for the mortgage and can limit what you can borrow.

There are pro’s and con’s with any shared ownership, so you need to be aware and consider what option (if any) suit you best.

When buying a home you may find that on your own you cannot get onto the property ladder, or may be restricted to a home that is not suitable for you. Therefore shared home ownership might get you closer to your dream of owning your own home.

The Pro’s (Benefits)

Many first home buyers struggle with having a large enough deposit and others are short on income to afford a large enough mortgage. That means you either have to keep saving while you watch house prices increasing, or see if shared home ownership is an option to consider.

- The main benefit of shared home ownership is it means you can buy earlier than you otherwise could.

- Buying earlier means you can buy at today’s prices rather than risking seeing house prices increase while you continue to save – even a 5% increase in value could mean that you have to pay a lot more for your home in even a year or two.

- You may get a better deal from the bank as they are lending no more than 80% and so the risk to the bank is less. In many cases that means a significantly lower interest rate on your mortgage.

The Con’s (Things To Be Aware Of)

Obviously you only own a share of the property and another party owns the remaining share, and so you need to be aware of the rules that apply with the various shared ownership options.

There are a number of things that you need to be aware of:

- Application costs – YouOwn has application costs when they will advise you of.

- Equity charge – YouOwn has an equity charge which you pay for using the money (equity).

- Share Buy-Back – your shared owner is buying a share of the property (typically 5% – 15%) and you will buy that share back in the future and at the future value. You need to understand how this works as over time with the property value that costs rises too.

When you enter into a shared home ownership agreement it will cover off these things and more, and of course your solicitor will explain these to you as well. Shared ownership is not free money but it can really help when other options might not work for you.

Ask The Experts

As mortgage advisers we have an indepth knowledge of the shared home ownership options and can discuss these with you. We can explain how it may work for you, discuss the pro’s and con’s and also compare to what other options may also work for you.

Shared home ownership has helped a lot of Kiwis into their homes, but it’s not always the best option.

You should always seek advice from those mortgage advisers that deal with first home buyers and the shared home ownership programmes too.