Today we arranged to refix a home loan and managed to also show Stephanie how she could save $50,000

How Simple Is This…

Stephanie had a home loan of about $360,000 and was paying $1,975 monthly.

The loan was at an interest rate of 4.55% which included a low equity margin as she had less than 20% deposit when she purchased the property.

First we reviewed the property value and found that the e-valuation showed that the value had increased. We purchased an e-valuation which cost $49.95 and requested that the bank review the value and remove the low equity margin.

The bank checked this and removed the low equity margin, but they do not do this automatically … you need to request this.

We then agreed with Stephanie to refix her loan at 3.05% which would mean that the repayments could drop to about $1,540 monthly.

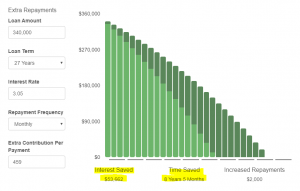

However we suggested that she keep the repayments at a similar level so increased slightly to $2,000 a month.

This means she is on target now to pay the loan off over 8-years faster and save over $50,000.

Are You Paying Too Much On Your Mortgage?

Banks are generally not pro-active about showing you how to save money on your mortgage as you savings means less profit for the bank.

They are quite happy if you are paying more.

You can review your home loans at any time and mortgage advisers will generally do this for you with no cost to you.

In Stephanie’s case we managed to get the low equity margin removed which was an unnecessary extra cost to her. That was something that she was unaware of and she was about to refix with the bank at a much higher interest rate, but instead we picked up that she was paying a low equity margin, we reviewed her property value and managed to get the competitive rates for her.

We believe many people are paying too much and therefore encourage people to contact one of our team to review your loans before you just accpet what the bank are offering and refix a home loan directly.