Are you an aspiring first home buyer or potential property investor and wondering when is the right time to buy?

If you are then you are not alone – as mortgage advisers we are hearing people asking this question all of the time, people that want to time it right so they buy at the bottom of the cycle.

Are house prices going down further, or are we about to see house prices start increasing?

When Will House Prices Start Increasing Again?

I think that most people, and economists agree that New Zealand still has a housing shortage; albeit that varies from region to region. There is a shortage in most cities, but also many smaller towns are struggling with housing supply.

Most economists also say that without any Government intervention, the house prices are driven by market conditions and the level of supply versus the demand.

The housing market in New Zealand has generally increased over time, driven by demand as our population has grown and a desire from most people to be located in the most popular areas.

We’re currently in a “soft market” where house prices have declined over the past 18-months and we are starting to hear that we may be about to start seeing house prices increase again.

What’s Changed?

A few things are changing (or have changed) that could lead to the decline of house prices firstly stopping, and then possibly quite quickly start increasing again.

We will discuss here:

- Inflation – it looks to have peaked and is on the way down

- Interest Rates – they look to have come close to a peak, so may soon be coming down

- Immigration – after years of closed borders, we are not seeing immigration increasing sharply

These are some of the key drivers that could drive change in the property market.

Inflation Skyrocketed, But Is Declining Now

It’s been a hot topic along with the cost of living crisis, which is really the result of the massive spike of inflation in New Zealand.

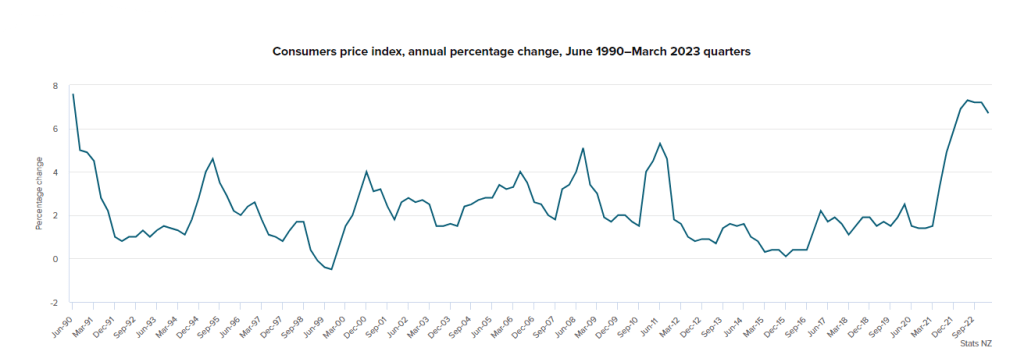

Excessive inflation is an enemy of an economy as effectively it devalues our money – the spending power of each dollar decreases as we are forced to pay more for the same items. For many years we have been used to a controlled inflation rate sitting in the range of 1% – 3% which was specified by the Remit for the Monetary Policy Committee, and “agreed by” the Governor and Finance Minister.

The blame for this out of control inflation has been firmly put on the Governor of the Reserve Bank and the Finance Minister who actively encouraged a borrowing binge to buy houses at wildly inflated prices, financed by dirt cheap credit, turning a blind eye to the breach of the target to which they mutually agreed and not learning the lessons of the Global Financial Crisis in 2008.

But regardless of the blame, it has happened and now the Governor of the Reserve Bank is trying to get inflation back under control using the Official Cash Rate (OCR) as the main tool.

Interest Rates Pushed Higher – To The Peak

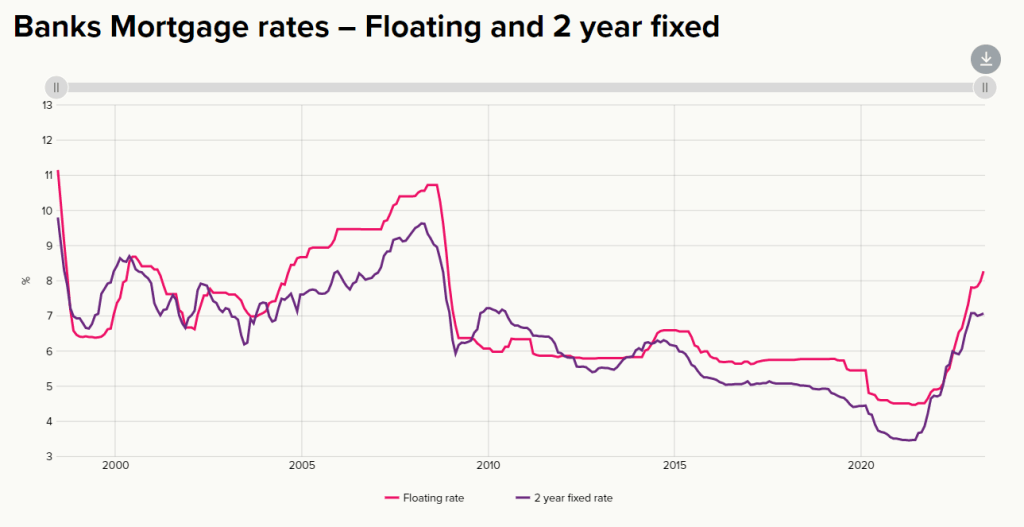

Home owners had gotten used to having home loan interest rates of about 5% – 6% for about 10-years until we hit COVID and the decision was made to drastically reduce interest rates.

We now know that interest rates did not need to be reduced as much, and definitely not to remain at those low rates for so long.

With the massive spike of inflation we saw the Governor of the Reserve Bank act, and that has led to the fastest every increase in the interest rates (and home loan rates) recorded and it’s been a shock to use all.

The glimmer of hope this week was the OCR announcement and more importantly the commentary where the Reserve Bank Governor Adrian Orr acknowledged that interest rates were constraining spending and inflation pressures were easing.

He went on to say that with the projections they have the official cash rate would remain steady at 5.5% through to mid-2024, with rate cuts from the 3rd quarter, the OCR dropping below 5% in mid-2025.

The good news is that this sounds like they believe that interest rates may have peaked.

Immigration Breaks Records!

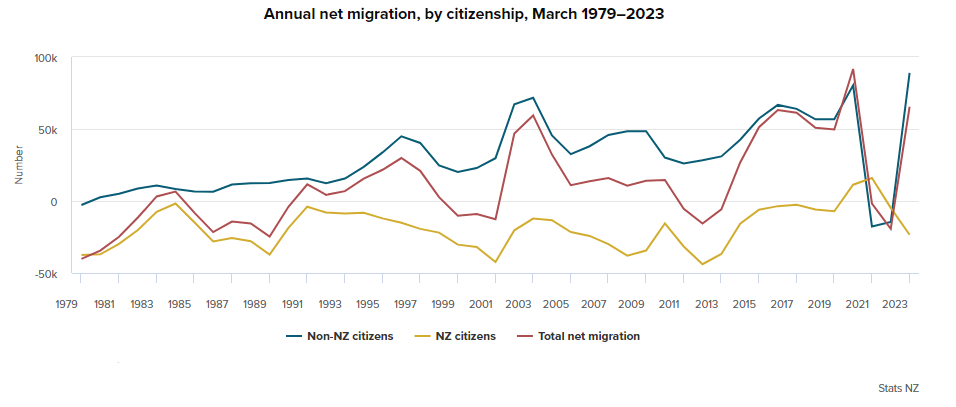

One of the key drivers of demand for property is our population growth which is hugely reliant on people shifting to live in New Zealand. Not all of these people will be buying homes, but they do all need to live somewhere so that has an impact on rents and house prices.

As we can see and would expect, during COVID we had and increase in net migration, but the gain of 65,400 in the March 2023 year was a bit of a surprise.

It was made up of a net gain of 88,900 non-New Zealand citizens, and a net loss of 23,500 New Zealand citizens, and has been recognised as a provisional record annual net migration gain, exceeding the previous peak in the March 2020 year.

The extra 65,400 people have to live somewhere, and that will certainly add pressure to the countries housing market – both the rental market and also with home buyers or investors.

Interestingly while Kiwis may think that house prices are finally getting to a more affordable level, many of those who are coming from overseas do not think that New Zealand property is too expensive and in many cases even think housing here is cheap.

In Summary – will house prices start increasing?

When we look at the combination of inflation, interest rates and immigration it’s hard to imagine that house prices will not start increasing, and soon.

Inflation has been the key reason that we have seen interest rates increase, so as inflation is on the decline we are expecting to see interest rates also decline in the near to medium future. If nothing else, we would expect that people will not be more comfortable to get a mortgage knowing that interest rates will not be expected to keep increasing.

We know that the the increased immigration will be adding pressure to the housing markets, and while this may hit the cities first it will no doubt impact the whole country in time.

There is talk that we might see house prices start increasing soon, and from the indicators it’s hard to see why they wouldn’t.

Maybe this means that window of opportunity to buy may be closing.