It’s important to get the right home loan, and that means understanding mortgage repayments as that is what can save you a lot of money over the long term.

I think a lot of people do know that you can repay your mortgage faster by increasing the repayments. But most people we speak to don’t really know the significance of how this works and are shocked, but pleased to learn more about how the increasing of mortgage repayments really can save them a huge amount.

Let’s Look At Understanding Mortgage Repayments Better

The key is to understand that a mortgage repayment is made up of the interest that you pay the bank and the principal, which is paid off the loan to reduce it.

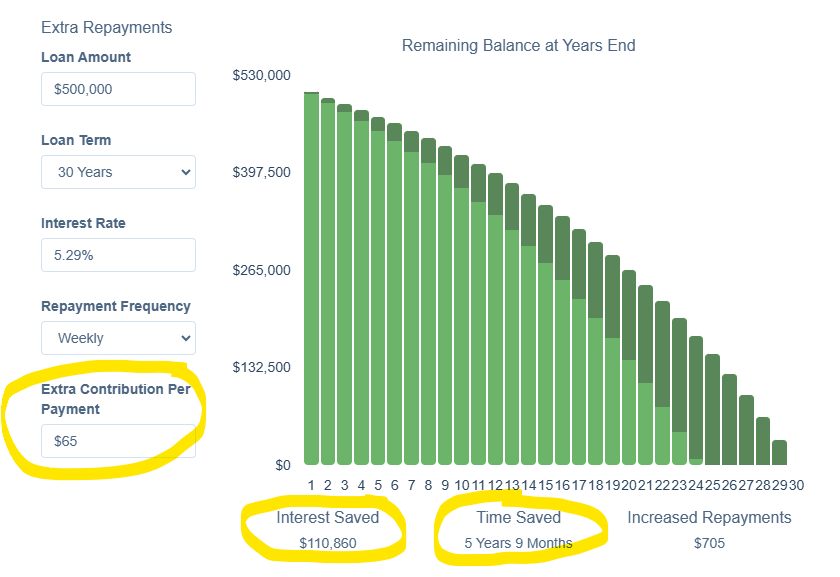

If you look at a $500,000 loan at 5.29% over 30 years, the weekly repayment would be approximately $640.

Of that payment, $510 is the interest and $130 goes towards paying that loan off.

Therefore, if you increased the repayment by $65, or about 10%, then most people think that is not a large increase (just 10%) but it’s actually a 50% increase on the principal amount that you’re paying. And that’s the key – you’re putting an extra 50% into paying your mortgage off.

By just doing that little bit extra it will shorten your loan term by about 5-years and save you over $110,000.

Imagine how good it would be to have no mortgage for 5-years more than expected, and to have $110,000 more in your pocket rather than lining the banks profits.

What To Look For When Choosing A Bank / A Loan

So when you’re looking at choosing the right home loan, you need to consider a few key points:

Will your bank allow you to increase the repayments by 10%, as in our example? Or will they restrict you to less, as many banks do? Could you even pay more? If you were to increase the repayments by $130, you would shave almost 10 years off your mortgage, which would save you close to $180,000.

It’s not always something that the banks want to encourage, but it’s definitely in your best interest if you can afford it.

When you are focused on paying your mortgage off faster, you might bite off a little bit more than you can chew.

Therefore, you want to ensure that your bank will allow you to decrease the repayments if you have overcommitted yourself.

The ability to both increase and decrease the repayments means that you can push that a little bit harder and commit to a higher increased repayment with the knowledge that you can back down a little bit if you find that you had committed yourself too much. Just having that knowledge that you can reduce your repayments again will often mean that you will commit to paying more.

We also know that in life, things can get a little bit more complicated. And that’s why it’s important that you have the knowledge that you can reduce your repayments again.

We also know that in life, things can go wrong and all of a sudden you need some cash and that’s where having an emergency fund is important. But also, the most efficient place to park your emergency fund is on your mortgage. The problem with most mortgages is the types of accounts that offer this flexibility (like revolving credit or offset accounts) mean that you’re paying a higher floating interest rate.

Most people would prefer to stick to the fixed interest rates, or at least have the majority of their mortgage on the lower fixed rates – it makes more sense.

So, if you have been overpaying your mortgage, a good feature to have is the ability to redraw what you have overpaid. You may have been overpaying by $65 a week, which is just over $3,300 a year and if you’ve done that for five years, that’s in excess of $15,000.

Should the car need significant repairs, you have something in the house that needs some work, or a health issue where you need to access some funds, wouldn’t it be good if you could access some of the money that you paid in advance on your mortgage?

Most banks will allow you to do a top-up, but very few allow you to access the money that you paid in advance without going through the process of doing a full application with the bank and that’s not always something you want to do, especially at that time that you just need that money in a hurry.

So in summary the key things you should look for are:

- The ability to pay more on your repayments – and not to be restricted to just 5%

- The ability to then decrease the repayments again if needed

- The ability to redraw from the excess that you have paid off

Some banks will downplay the importance of having this flexibility, but that’s because the bank does not always want to encourage people to pay their loans off faster. When you start understanding mortgage repayments better then you will also make better decisions, and those decisions can save you a lot of money on your mortgage.

Why Not Focus On The Lowest Interest Rates?

Of course, having a good interest rate is really important and especially having it consistently over time.

What you will find is that most banks do offer competitive interest rates, and while they might not offer the best interest rate every day or every week, you’ll find that most banks are pretty competitive most of the time.

If you want the lowest interest rate then that will make it difficult to choose a bank to go with as one bank might have slightly lower interest rates today, but tomorrow it might be a different bank. Banks are always adjusting the rates that they offer based on the cost of funds to the bank, and what they need to do to remain competitive. Most of the banks in New Zealand will try and be competitive most of the time, and as mortgage advisers this is something we always push with the banks too.

Interest rates are important, but having the ability to pay extra off your mortgage is going to be what saves you more money over the long term. That’s why we suggest that the flexibility should be the main focus – it’s one of the things that at Mortgage Managers we really focus on.

Do You Want To Pay Your Mortgage Off Faster?

Hopefully the answer is YES – it should be YES.

Therefore you need to know your mortgage and the features within the loans and most importantly understanding mortgage repayments and what you can change with yours. It’s something that we find that the banks are not good at explaining, and even many mortgage advisers don’t give this the focus that it needs to have.

While winning a lotto and being able to pay the mortgage off would be great, the more realistic option is to make an effort to pay it off yourself and as fast as you possibly can. To do that, it’s often about understanding mortgage repayments and having the flexibility to make smaller changes regularly so that you can take advantage of situations as they arise.

- If you manage to get a lower interest rate when you’re refixing, then keeping the repayments at the higher level can make a huge difference.

- If you get a pay rise, then you may want to enhance your lifestyle a little bit, but if you can also put some extra money onto your mortgage, that will give a better long-term outcome.

- If you’re doing your budget and you manage to see some area where you can get some savings, then put that towards your mortgage and try to pay it off faster.

- Or if you do have a savings account for that rainy day, then maybe that is better put into the mortgage as long as you can still access it for that rainy day.

Most people really want to get their own home and that is a huge focus, especially earlier in life. But once you have that first home, the focus switches to wanting to have no mortgage, to be mortgage-free so that you have more money in your back pocket for your lifestyle.

That’s not going to happen without some effort and planning, but it can happen faster than you focus on the importance of understanding mortgage repayments and have a strategy to work with.

Start by contacting a mortgage adviser to discuss your situation.