If you ever wondered why it’s a good idea to have a mortgage adviser refix your loans then just ask Linda.

Linda has a home loan with ANZ Bank and asked if we could look to get some rates and refix her loan.

Of course at Mortgage Managers that is what we do … we help people manage their mortgages better.

You Can Refix Your Loans Directly With Your Bank

Linda had been offered rates by ANZ and she could have simply refixed on her banking App.

Luckily she knew it would be better to contact a mortgage adviser.

She did not trust that the bank would be looking after her best interests.

The interest rates that we were able to get Linda were the same as what she could get from ANZ but in this case she got some advice that saved her over $3,500

What Extra Advice Did Linda Get?

As mortgage advisers when we review a mortgage we look at more than just what interest rate we can get to refix the loan.

A mortgage adviser review will of course look at what rates can be offered and to make sure that they compare well with what else is available from the other banks. In this case the rates offered by Linda’s existing bank were as good as any other banks, so that was all okay.

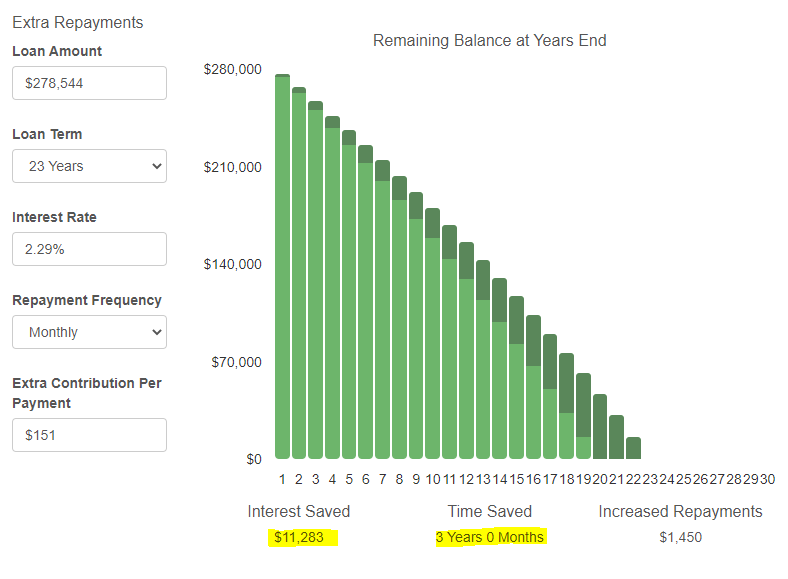

Linda also had another loan that was fixed for another 12-months at 3.55% so with the mortgage adviser review we checked the cost of breaking that loan early so we could assess if it would be worth paying a break cost to refix the loan at a lower rate. In this case the break fee was only $1.90 and yest the interest rate was 1.26% less which on the home loan of $278,544 equates to a saving of just over $3,509

Furthermore we helped Linda potentially save even more!

She was paying $1,461 monthly on her home loan, and with the lower interest rate this could have dropped to $1,299 monthly; however we showed Linda that keeping a higher repayment of $1,450 would potentially shave 3-years off the loan term and save her over $11,000 more.

Was It Worth Getting A Mortgage Adviser Review?

One of the benefits of getting a mortgage adviser to review your loans is the banks pay the adviser so it costs you nothing.

Of course Linda was very happy that she got a review with Mortgage Managers rather than just accepting what was offered by the bank (ANZ) which was always easier but of course would have ended up costing her a lot more.

As she mentioned in her review on Google, she “hadn’t even thought of breaking the other fixed loan” and it’s not something that the banks highlight either.

At Mortgage Managers it doesn’t even matter if you have never spoken to them before – they will still be happy to review your loans.

"*" indicates required fields