We all want low home loan interest rates!

Home loan interest rates are at an all-time low and while there have been some economists suggesting they may still go lower, now is a great time to stop and look at what you are doing about your own home loan.

If you have a fixed rate loan you might think you need to wait until the end of the fixed term, but there may be a good reason to make the changes to a lower rate now even if your bank plans to charge you a fee for breaking the fixed rate.

Should you restructure your existing mortgage or refinance to another bank?

Stay With Your Bank

If you are happy with your existing bank and they are willing to offer you competitive interest rates then it does make sense to restructure and refix your existing home loan.

As mortgage advisers we are happy to work with your existing bank and we view our role as helping you to get the right loan structure and negotiating the best interest rates for you.

In essence we can act as your personal banker or ‘go to person’ with the added advantage that we are looking after your best interests rather than the banks.

Is It Time To Change Banks?

If surveys are anything to go by many Kiwis are not happy with their existing banks but just don’t change as it is seen as a “hassle” however it is not really that hard to change banks and often the benefits can be massive.

There can be some huge benefits of refinancing and as mortgage brokers we can advise you on what to do and which bank has the best loans (products) for you.

CLICK HERE to try our refinancing calculator.

A Real Life Example

This week we reviewed a couple’s mortgage this week and they had been paying 5.85% on loans of $385,591 with 24 years remaining.

Of course they knew there were some low home loan interest rates available, but they wanted to be sure that their bank was offering them a competitive interest rate too.

Their bank was Westpac and had offered them “a special’ rate of 4.39% fixed for 2-years which seemed like a good rate and was definitely a lot better than what they had been paying, but they asked us what we could do.

This is the advertised special interest rate.

We approached their bank and we negotiated a 2-year rate of 4.19% for them.

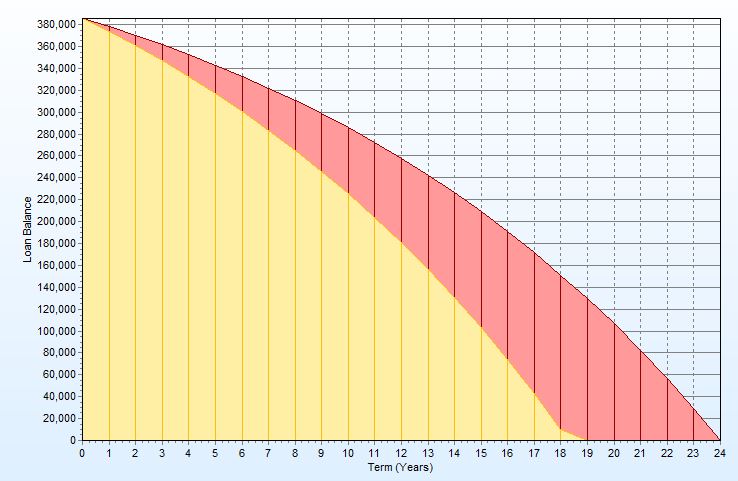

This graph shows the impact to our clients of the low home loan interest rate that we negotiated;

Moving from an interest rate of 5.85% to 4.19% and keeping the repayments the same will mean this couple will shave 6-years off their loan so it is paid off in 18-years instead of 24-years. This also saves them about $90,000 of interest that they would have paid the bank.

The small additional reduction that we negotiated saved them $9,000 and cost them nothing – this is a free service we offer.

Contact your local Hobsonville mortgage brokers to discuss your loans in confidence.

Phone: 09 416 2073 (or Stuart after hours 021 984340)