KiwiSaver is being used as a large part of the deposit for first home buyers’ so it’s worth spending a little time to understand the options.

Of course it’s great that people are managing to save using their KiwiSaver, but it does also raise a few questions:

- Are you in the right KiwiSaver plan?

- Are you contributing enough to your KiwiSaver?

- Are you contributing to any other savings?

If we just dive a little bit deeper into the KiwiSaver plans, there are a number of providers offering KiwiSaver in New Zealand.

It’s important to understand that KiwiSaver was primarily set up as a superannuation scheme to be accessed in retirement. However, first home buyers have the option to withdraw from their KiwiSaver for their first home deposit.

Are you in the right KiwiSaver plan?

Unfortunately a lot of Kiwis have not taken much time to think about which provider they’re saving with and what funds they have chosen. Often people are just in the default KiwiSaver scheme that they were originally set up with, or they may have transferred to their own bank.

This is not great for first home buyers, but it is easy to fix.

Neither of those are necessarily the greatest options.

Most financial advisors would suggest that you invest your KiwiSaver with a specialist investment company rather than a bank or insurance company that may have tacked on KiwiSaver as another product option.

You then need to look at what your provider is investing in.

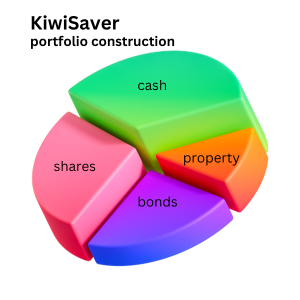

Most KiwiSaver providers have a range of fund options, from the conservative through to the more aggressive.

Generally speaking, conservative funds invest in cash and bonds, whereas more aggressive funds invest in shares and commercial property investments, plus a few will invest in other assets like commodities and even cryptocurrency.

Many financial advisors will put you through a short series of questions to ascertain what you should be investing in, however there are some major faults with the questions that are asked.

One of the most obvious faults is the age or time frame that you’re investing for – where KiwiSaver was set up as a retirement fund and therefore is not accessible until you turn 65, if you’re a first home buyer you may be wanting to access it this year, next year, or maybe the year after, and therefore instead of being a long-term investment it’s a short-term investment.

If you went through the series of questions that most financial advisors or websites have, you would likely be put into a fund designed for long-term investment rather than short-term.

The other major flaw with many of these profiling questions are they look at just your one investment, i.e. your KiwiSaver. Many Kiwis will have other plans to help fund their retirement, whether that be other investments or business assets to sell, or potentially an inheritance.

Those other things are often never considered when you complete one of the investment profile questionnaires, and therefore in many cases they’re not going to give you the accurate results that they were designed for.

Keep Investment Decisions Simple

If you want to keep it real simple, then the conservative funds are at the lower end of the risk profile.

Most cash-based funds will rarely decline in value, but they also will generally give the lowest returns over the longer term. If you want to start being more aggressive with your investment then you are potentially investing in shares and property which are assets that have more volatility.

You may have also have exchange rate risks because you’re investing offshore, and therefore a small movement in the value of the New Zealand dollar can affect your investment either positively or negatively. This is not such an issue with a long-term investment, but it can be an issue with short-term investing.

About Investing In Shares

If you’re investing in shares, you’re actually investing in small parcels of companies, and therefore the return on that investment is directly related to how that company performs.

So often it depends on the mix of the investments and whether they’re within New Zealand or offshore in another currency. Some investment managers will actively look at the companies that have potential for growth, where others will have a more passive strategy where they will just select an index of shares and invest and spread your investment through those.

The active managers tend to have higher fees, but the aim is to have higher returns.

When you’re investing in shares, you will see the values of those shares pop up and down quite a lot, and therefore these are always deemed as a higher risk which means they are suited for longer term investments.

About Property Investments

The same can be said with the property type investments (generally commercial properties) which include things like shopping centres, retirement villages, and office blocks. These types of investments can do very well when the economy is doing well, but when there’s lack of confidence in the economy they can end up with low returns for extended periods of time. Again, property-based investments should be considered more for the long term.

Then There Are Commodities and Cryptocurrencies

The other type of investments that we just touched on very briefly were things like commodities and cryptocurrencies.

Commodities are generally a very active type of investment form, investing in things like oil, coffee beans, and grains. The managers may be doing it either on a short-term trading basis or offering futures on those commodities. It’s quite a specialised type of investment, and those managers that are good with those types of investments do particularly well, but there are some things that are out of your control and therefore you can easily have negative returns as well.

Cryptocurrency is one of the investments that financial advisors have been wary of in the main, because of the unpredictability of the investment class.

It’s fair to say that cryptocurrency has now become more mainstream, and some investment managers are using it like other investments such as gold or silver where they can rely on the limited supply to help retain value. The future of cryptocurrency is still a little unknown, but many people enjoy having at least some exposure to crypto within their portfolios now, either doing things directly themselves or within their KiwiSaver.

Within their KiwiSaver, crypto is still regarded as a high-risk asset class, and therefore for longer-term investment.

Investing in Crypto More Directly

When people invest directly into crypto, they generally either buy through companies like EasyCrypto, which is based in New Zealand, or it’s becoming more common for people to get into the mining of crypto instead. BeepX is a great platform for mining crypto.

As mentioned, crypto is relatively speculative and high-risk and therefore should not be relied on, but it can be something that you may want to try in the hope that you’ll get good returns and increase your deposit quickly.

Selecting Your Fund

So if you’re investing in your KiwiSaver, but you plan to withdraw the money for your house deposit within the next three years then you should consider what options you use and the risk within the investments.

- Are you prepared to have the value of your KiwiSaver, and therefore your deposit, reduce?

- Or are you wanting to ensure that you have no losses, even if it means potentially less return?

We could put you through an investment profiler, but there’s really no need because it’s an easy decision for you to make. The profilers are used for retirement planning, but not so much for first home buyers

Go Aggressive – if you want to take the risk but try for a larger deposit, then you can be aggressive with your investment. Many young people are quite happy to take a risk, but in the hope that they will have a larger deposit. But it’s important to understand that your investment can always go backwards as well, so you could end up with a lesser deposit.

Go Conservative – if you want to ensure that you’ve got no losses, then you need to be conservative and make sure your investments are in cash-based assets.

Or The Balanced Approach – if you want to foot in both camps, then most fund managers offer a balanced type investment, which has some exposure to shares and property, but also exposure to the cash investments.

Get Advice on KiwiSaver For First Home Buyers’ Deposits

The team at Mortgage Managers have helped a lot of first-time buyers over the years, and therefore dealt with a lot of people and their KiwiSaver investments.

We’re happy to have a chat with you about your KiwiSaver, and explain the ins and outs of the various providers, and the types of funds that you can invest in.

If you have any questions, please feel free to reach out to us, and we’ll be happy to help you and explain the ins and outs of the various providers, and the types of funds that they offer.

It costs you nothing to have a chat with one of the team, and at least it gives you some confidence that you’re investing in the right KiwiSaver for the right reasons and most suited for first home buyers.