With home loan interest rates at all time low’s there is an opportunity to pay off your mortgage faster and without any pain.

This week we worked with James and showed him and his wife how they could pay their mortgage off faster without committing to increasing the repayments.

How James Is Paying Off His Mortgage Faster

James and his wife purchased their first home in took out their mortgage in 2012.

The mortgage was split into three loans;

- A small revolving credit loan – this provides the flexibility for James and his wife to pay more when they can, but was also very useful for the period of time when they started their family and went down to one income for a period.

- A fixed loan – fixed for 1-year initially.

- A fixed loan – fixed for 2-years initially

Interestingly at that time they were paying 5.80% on the fixed loan for 1-year and 6.00% for the 2-year fixed.

Now that home loan rates are so much lower there is an opportunity to pay off the mortgage quicker.

One of the loans was about to come off the fixed rate.

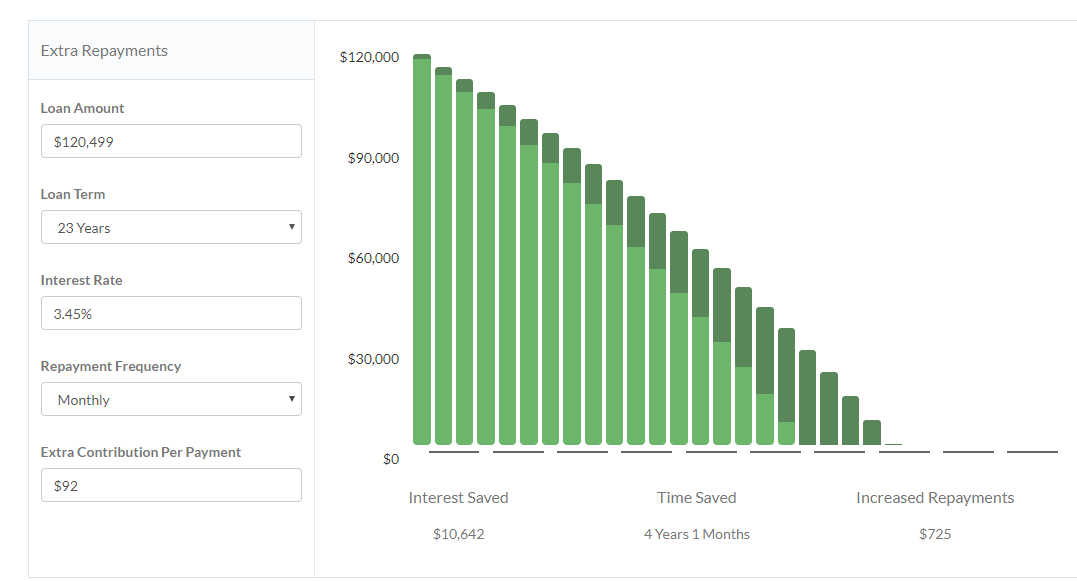

The loan was fixed at 4.65% and the repayments on this were $724 monthly.

Now we can get them an interest rate of 3.45% for 2-years fixed, and the repayments would normally reduce to $633 monthly.

As mortgage advisers we suggested that they keep their repayments at a similar level to what they were paying ($725 monthly) and showed that they would cut the loan term by 4-years and save over $10,000 in the interest that they would normally pay.

Start Paying Your Mortgage Off Quicker Too

As you can see from what James is doing the savings are huge and yet this is costing them no more.

As you can see from what James is doing the savings are huge and yet this is costing them no more.

This is a simple method, but it works well.

Of course, if you want to pay off your mortgage even faster there are other things that you can do.

You can speak to one of our mortgage advisers or subscribe to our mortgage reduction system.

Maybe it’s time to review your mortgage.