As a mortgage broker I get asked all the time if it is better to wait for home loan rates to drop, or is it better to just refix my loans on the rates offered today.

Of course it is great that people are taking the time to think about this.

Should I Wait For Home Loan Rates To Drop?

This is a really good question at the moment as there has been some talk about The Reserve Bank adjusting the OCR again before the end of the year.

There has been a lot of talk about another fall in interest rates, but I’m not so sure.

Here is a short video where I share my view on interest rates and why I believe that we may not see another cut to home loan rates this year.

As a mortgage adviser we cannot predict what will happen with interest rates, but we can have a look at what is happening and share our thoughts with you.

Please feel free to subscribe to my You Tube channel.

Or you can contact the office and talk to myself or one of the team.

Why To Speak To A Mortgage Broker

Too often we see people who just accept what the bank offers them, when we know that they could have done better.

It is important to remember that banks are a business and the first priority of any business is to make money for their shareholders. Of course they also want to retain customers and for this reason they will always make out that they are looking after you.

But so often what they offer is not competitive, and in our role as mortgage brokers and advisers we will always endeavor to keep the banks honest so that you do get offered the best home loan rates.

The best way to explain this is to use a real example.

These are the home loan rates offered by ANZ today (25th August 2016) and most people will look at the rates and think they are quite good, especially when refixing after being on higher rates. As well as these advertised fixed rates, the ANZ website has a rate of 5.59% for the floating rates and 5.75% for their Flexible Home Loan which is their revolving credit option.

As mortgage brokers we were approached by an ANZ customer about looking at the home loan rates they were being charged and to see if we could get something better for them.

We approached ANZ and explained that an existing customer of ANZ had approached us and asked us to get better rates for them. The customer was being charged a discounted floating rate of 5.24% on loans of $614,562.

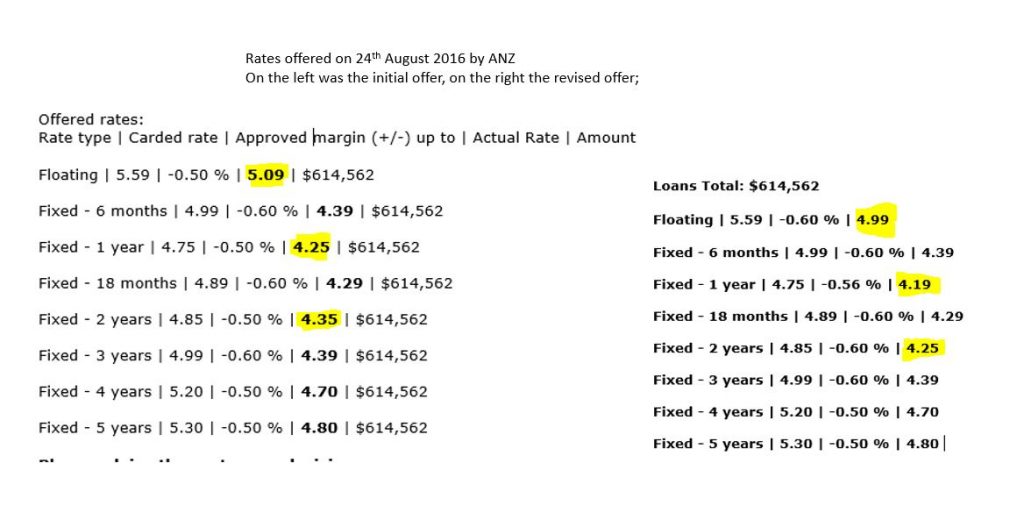

In our first approach to ANZ we were offered a further discount on the floating home loan rate reducing it to 5.09% and the standard special 1-year and 2-year fixed rates.

As mortgage brokers we deal with a range of banks and knew that we could refinance these loans to another bank and get lower home loan rates, so we went back to ANZ and explained that they needed to come up with more competitive rates. They then came back and offered lower home loan rates of 4.99% for the floating home loan, 4.19% for 1-year fixed and 4.25% for 2-year fixed.

Would the ANZ have offered these lower rates if the customer had gone directly to the bank themselves? Probably not.

How Much Can You Save?

Every situation will be different but if you ask us to look for a better home loan rates we will do our best to ensure that they are competitive with what the banks are offering. How much you actually will save will depend on the size of your loans, the specific bank and how much margin they have to work with at the time.

The best part for you is that as mortgage brokers we get paid by the banks when we negotiate and refix your home loans – which means it is a FREE service for you. It doesn’t matter if we did not arrange your home loan either.

In this customers situation they were definitely able to save money by using a mortgage broker to negotiate the lower interest rates.

They have home loans of $614,562 and at the rate they were on of 5.24% they were paying interest of $32,203 per year. If they accepted the first offer they would have reduced the interest they were paying to $31,281, but with the rates we were able to negotiate they reduced the interest that they pay on their home loans to $30,667 which saves them $1,536 over the year.

This is just an example of how a mortgage broker can work for you.

This does not include the advice that you can get (for free) and the way in which a broker can structure your home loans so you can pay off your home loan faster and a few tricks to save even more money.

Why Should You Speak To A Mortgage Broker?

Hopefully this has explained why you should speak to a mortgage broker when your home loan rates comes off a fixed rate.