Today we felt compelled to post about sensible debt consolidation loans.

Why?

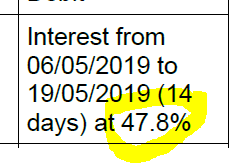

Because today we were putting together a debt consolidation loan application and saw one of the highest interest rate charges that we have seen in a long time.

Our client had a loan and was being charged 47.8%

Sometimes we are shocked when we look at the amount that some finance companies charge.

Our client took out the loan for some urgent car repairs and in the rush to get the money did not really take much notice of the interest rate that she was being charged.

She even acknowledged that it was “crazy” but said she was needing to sort out the money quickly and so just signed up.

We Arrange Sensible Debt Consolidation Loans

There are times when we all need to borrow money, and sometimes there is some urgency.

But you do need to be careful with what you sign up for, and it’s best to take a little bit of time to ensure that you are getting a fair deal.

You can always check out websites like interest.co.nz which show the various interest rates on offer from the finance companies and other lenders and you may be staggered with the way that interest rates do vary.

Banks are not always the best or cheapest options especially for unsecured loans. Banks like ASB will charge from 13.95% to 19.95% for an unsecured personal loan. A bank like the New Zealand owned Co-Operative Bank is one of the better banks and generally has some of the lowest rates.

There are also peer to peer lenders, credit unions and finance companies that offer personal loans.

Many of the finance companies will scale the interest rate charged depending on the applicants circumstances. Some of the interest rates from the better known and popular finance companies are very high too with companies like Finance Now charging between 12.95% and 29.95%, Gem charging between 12.99% and 29.99% and Geneva Finance is similar too with rates between 11.95% and 29.95%.

You need to watch out for the fees charged too.

Get Professional Advice

Yes, we are mortgage brokers but we also arrange a lot of personal loans and sensible debt consolidation loans.

We generally do not provide instant approvals as we prefer to get loans that are suitable and match the purpose and are working with a number of banks and other lenders to source the right options.