As mortgage advisers with mortgages of our own we have never liked how the banks promote the idea of the easy ‘one-click’ refixing of loans on the banking Apps or websites.

We do understand that it’s easy, but just because something is easy does not mean it’s a good idea.

In many cases taking the easy path in anything we do is rarely as good – and in our experience refixing on the banking App is a bad idea too.

Banks Make Refixing Easy

Banks have made a big effort to make things easier for customers, and maybe we should ask why.

There are probably a few reasons and they are not necessarily what the banks would tell you.

Here are a couple of my ideas on why I believe the banks have made a push to promote refixing of loans on the banking Apps or websites.

- Yes, it’s quick and easy and Kiwi’s like that.

- Automated processes save the bank money (therefore helps the banks profits)

- This removed advice and therefore risk as it’s the customer (you) making the decisions and therefore it’s your fault.

- Kiwi’s are less likely to review what else is available – we’re generally complacent and trust the banks – but we shouldn’t.

- Overall – it’s more profitable for the bank.

But just because something is easy does not mean it’s good.

The ‘one-click’ refixing of loans on the banking Apps or websites is a perfect example of why easy is not good.

Refixing With An Adviser

Many people that will read this may think that we’re just saying this because we are advisers and because we want people to refix their mortgages with us as we get paid for that. Most advisers will not dispute this, but we’re also not doing mortgage refixes just for the money as we do not get paid that much for doing them (typically $150).

As mortgage advisers our whole purpose is to give advice and that is for sourcing the mortgages but also for helping people pay their mortgages off faster, and to be honest paying off the mortgages is where advisers can really add value and it’s also something that the banks are not good at – it’s of no benefit to the bank to help you save money.

We like to think that we can keep the banks honest – to make sure that the customer (you) are being offered advice, given the options and ultimately are given a competitive deal by the bank.

If the bank that you are with is not looking after you, then we will suggest alternatives.

Obviously your bank is not going to do that – they’re not going to say “head over to this other bank as they have better options and more competitive interest rates” … it just doesn’t happen.

It’s all about getting good advice.

Let’s explain why we think that refixing on the banking App is a bad idea, and for this we will use a real life example that we had this month. This is just one example, but it’s typical of what we are seeing all of the time and the worst thing is we know for each of these that we see and are able to help – there will be a lot more people that are using these App’s to refix their mortgages quite unaware of how much it’s really costing them.

Real Life Example – Linda’s Story

It’s easy to talk about the advantages of having an adviser help with refixing your loans, but as mentioned easy is not always the pathway that we take.

We thought it would be better to illustrate why we say that in our experience refixing on the banking App is a bad idea by using a real life example that we have had this month – April 2024.

Linda (real name) has her mortgage with New Zealand’s largest bank which as advisers we are not allowed to name, but this story is not unique to any specific bank either.

Fixed Term Ending – Linda had her fixed term loan coming to an end and she was provided new rates by her bank. Before she went ahead and locked in her new rates, she wanted to get some advice and so reached out and we discussed her options, and of course the rates that were offered. The rates offered were shown as “special” rates and discounted from the advertised (carded) rates, but we knew that they were not as good as other banks were offering.

Tried for Better Rates – it would have been easy for Linda to accept that the bank was offering her something “special” and therefore she could have just clicked to lock in these rates. Luckily Linda is a person that likes to get advice and so we had the opportunity to review what she had been offered. Obviously when we saw the rates that were offered we contacted the bank to see if they could be a bit more competitive, but unfortunately in this case they were not willing to do any better.

Refinanced Linda’s Mortgage – given that this bank was not competitive we were left with no other option but to refinance Linda’s mortgage. It’s not that we do not like her existing bank, but as advisers we need to ensure that we are doing the right thing by our clients and in this case her bank was not willing to offer competitive rates and so when we provided options it made no sense to stay with the bank and in fact doing so would have been detrimental to Linda.

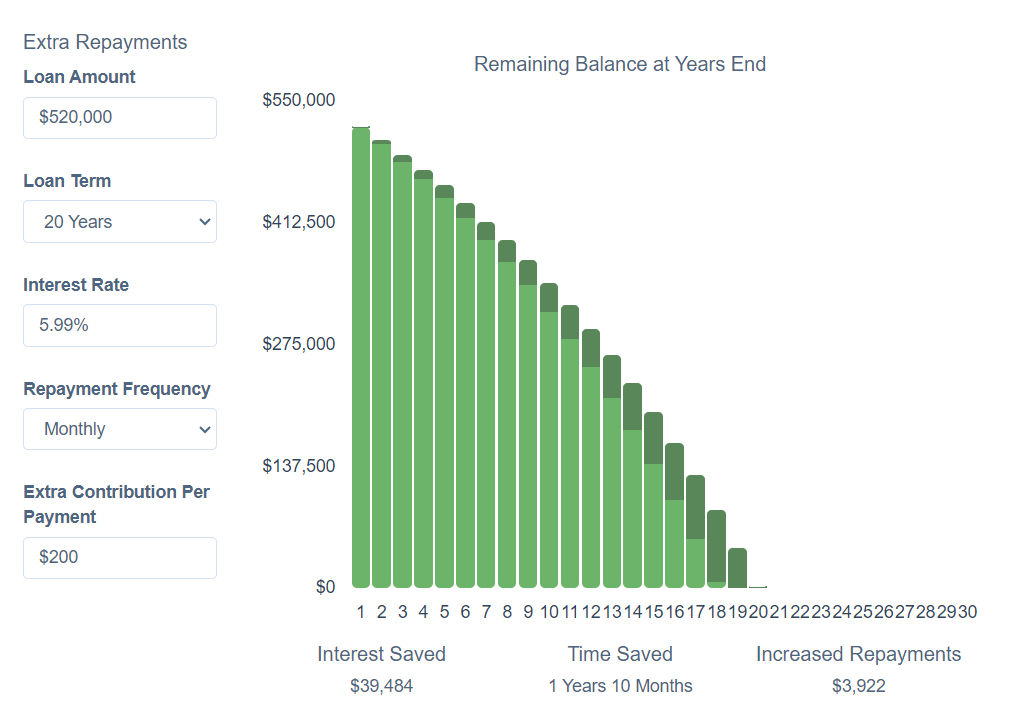

Better Interest Rates – we refinanced her mortgage and were able to secure a 3-year fixed rate of 5.99% compared to the “special” rate she had been offered of 6.65% and this meant that the repayments could be $200 a month less. She could have just selected the lower repayments too, and without advice probably would have – but when we showed her the impact of paying the extra $200 a month on her mortgage there was no way that she would pay the lower amount.

Paying More & Savings – as you can see in the diagram below, by taking the lower interest rate but still paying the same higher amount Linda is able to shave another 2-years (almost) off her mortgage term, and that will save her almost $40,000! That’s money that would have normally have been paid to the bank, and would have helped the bank report large profits while people like Linda continue to pay their mortgages.

Extra Cash Too – there is always a cost to refinance (solicitors fees) but most banks are willing to give a cash contribution to attract new customers. The cash does vary from time to time and bank to bank, but there is normally enough to cover the solicitors fees plus more. In Linda’s case there she received enough to pay the solicitors costs and also for a wee break to Fiji which she has booked for July.

As mentioned, Linda’s story is very typical of what we see.

We see so many cases where customers are encouraged to take the easy path and that means refixing on the banking App with zero advice and the rates that the banks has offered.

Linda reached out and we were able to provide advice and ultimately that meant refinancing – but she ended up so much better off.

Small Extra Repayments Make A Huge Difference!

Do you know why even small extra payments make such a big difference?

Most people are surprised to see what even a small amount extra can save you on your mortgage, and Linda was no exception. She knew that it’s good to pay more, but had no idea just how much difference a small amount extra makes.

The thing is, Linda’s standard repayments at the lower interest rate (5.99%) would have been $3,722 monthly, and that includes interest of $2,595 which means that the loan is being reduced by the principal amount of $1,127.

So the extra $200 that she would have been paying to her existing bank means that she is paying just an extra 5% (approx) on her loan repayment, but it actually means she is paying an extra 18% off the principal.

Try our mortgage calculator and see what you could be saving.

The illustration above is from the second calculator.

Now What About You…

We’ve helped Linda as you can see, but we know that there are hundreds of people (no, probably thousands) that could do a lot better too.

Have you had anyone review your mortgage?

If you have a mortgage then you can review it at any time. Often it’s when your loan is due to be refixed that you decide to look at options and might contact a mortgage adviser, but that does not mean that this is the only time that you can review things.