Over recent months many of the major banks have started trying to charge property investors higher interest rates.

As established Auckland mortgage brokers we will often negotiate interest rate deals with the banks and now as part of this process with banks some are asking the use of the property – is it an owner occupied property or an investment property?

Why Should It Matter Who Occupies A House?

The actual properties (houses, townhouses and apartments) are all the same regardless if they are occupied by an owner or a tenant, but the banks tell us that the risk of mortgage defaults is higher on those properties used as rentals.

If there is another Global Financial Crisis or even a depressed local economy then the banks fear that there will be more mortgage defaults.

Human nature dictates that people will let a rental property or a holiday house be sold before they would let their home be sold.

If the banks were solely looking to minimise risk then you would expect that they would also factor in the equity within the property too as the higher the equity, the less the risk. Most property investors will have at least 20% equity in a property based on the old rules, and for properties purchased more recently most investors are having to put in a 40% deposit. With these large amounts of equity the banks risk reduces significantly and therefore we would argue the reason for having a higher interest rate no longer exists.

So It Happens In Australia…

The banks that are charging property investors higher interest rates are the Australian owned banks, so that is most of them.

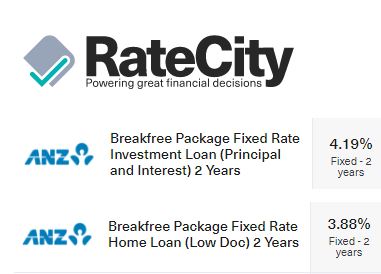

In New Zealand we have ANZ Bank, ASB Bank, BNZ and Westpac that are all owned by parent banks in Australia. They have taken the stance that because in Australia they charge higher interest rates like the ANZ 2-year fixed rate shown (as at 22/11/2017) which they charge 4.19% as a property investment loan whereas as a home loan they charge the lower interest rate of 3.88% which means property investors are paying almost 8% more than home owners.

We’ve seen it reported in Australian media that it “makes sense” for banks to charge property investors higher interest rates because their loans have a different risk profile to those being paid off by people living in their home. What banks might say if they were being entirely truthful is that it “makes sense” to charge more where we can as this is an easy way to increase our profits. Now I’m sure they would argue this point, but the banks cost of funds is the same regardless if the money is then loaned out to borrowers for home loans, property investment loans or for that matter personal loans.

Ask Your Mortgage Broker To Negotiate Interest Rates For You

You can jump up and down and insist that your bank provide you lower mortgage interest rates, and sometimes the banks might move a little.

Another way, and an easier way is to have a mortgage broker do the negotiations for you.

The advantage that a mortgage broker has is he/she is dealing with a range of banks all of the time and therefore has a pretty good idea of what interest rates to expect and therefore how hard to push-back with the various banks. Also when a bank gets contacted by a mortgage broker they know that the mortgage broker knows what the other banks are offering and suspects that the mortgage broker will advice you to shift to another bank if the rate offered is not competitive.

While there is no guarantee that a broker will get a better interest rate than the bank might offer if you went direct, they will ensure that you are getting a competitive interest rate which should never be any worse than what the banks would offer directly.

Plus, most New Zealand mortgage brokers will not charge you to negotiate interest rates as they generally get paid by the banks for this.

Be Prepared To Refinance Your Loans

Be Prepared To Refinance Your Loans

If you want to “threaten to refinance” to another bank you want to be prepared and know that you have that option.

As customers you go to a bank to get money, and the money is the same no matter which bank provides it. For this reason people do shop around and mortgage brokers by nature shop around for their clients too. It is important to ensure that the banks are treating you well and providing you with competitive interest rates.

As property investors the interest rate that you get charged is very important as this directly impacts the profit that you make on your investment. The interest that you pay is typically the largest expense that you have for a property so it can mean the difference between a loss versus the same property having a break-even or even a profit.

While some banks have started to charge property investors more, other banks do not.

It makes a lot of sense to support those banks that support property investors, so if you are being charged higher interest rates by your bank then maybe it’s time to look at making a change and refinancing your mortgage to an investor friendly bank.