Kiwis can be too complacent and not always focus on the important things with their finances, like KiwiSaver.

The majority of people have their KiwiSaver with a bank or with the provider that they were automatically enrolled with when they started. Often these are not the best providers and often people are not in the appropriate funds.

There are a lot of choices, and very few people that can give good advice on KiwiSaver.

Who Can You Get Advice From?

One of the problems with KiwiSaver is it was set up to be an “easy” retirement plan for all Kiwis, and because the Government wanted people to sign up they were not too concerned who was “selling” KiwiSaver.

That meant that we saw the banks jump on this opportunity and create KiwiSaver options that they could sell to their customers. When a bank suggests a KiwiSaver provider they are giving you just that one option the bank has and that can hardly be deemed good advice.

Some of the other non-bank KiwiSaver providers had their own marketing and sales teams “selling” their funds, and like the banks they have only been able to offer the funds that they have – their own product. Again, that can hardly be deemed good advice.

We also saw a range of financial advisers “selling” KiwiSaver and while some had a range of options and made the right decisions, many had just one or two options and never really provided much advice.

What you really need is someone that is a specialist in just KiwiSaver and can therefore be solely focused on this.

KiwiSaver Will Become A Large Investment

Often people don’t realise how much money they could have invested in their KiwiSaver funds.

For most of us, and especially if younger then KiwiSaver will grow to a significant sum of money even if you are just contributing the minimum 3%.

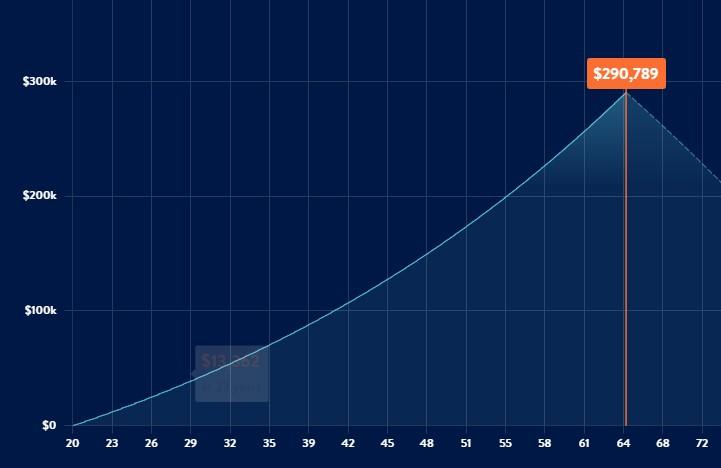

Below is a calculation that we did on the Sorted KiwiSaver calculator using a 20-year old on the average income of $1,189 weekly ($61,828pa.) contributing the minimum 3% and showing how that builds up over the years to almost $300,000 by the time that person reaches 65-years old.

That figure is not allowing for inflation (then the actual figure would be over $700,000) and it’s for just one person, not a couple.

Who would you want to trust to look after your money?

KiwiSaver, like any investment should be reviewed by someone that is a specialist and most people will never have theirs reviewed, and I would suggest that the person that signed them up to KiwiSaver is either no longer around or would not know how to do a review.

Partner With A Specialist

Our financial advisers at Mortgage Managers know a bit about KiwiSaver but are not specialists.

We would suggest that most people that are “selling” KiwiSaver are not specialists either.

What we have done is aligned ourselves with John who is a specialist, and we suggest that you review your KiwiSaver with the John today.

Just complete the simple form below and he will get in touch to arrange your free review.

John is a specialist who provides personalised KiwiSaver advice to help you achieve your first home and retirement goals.