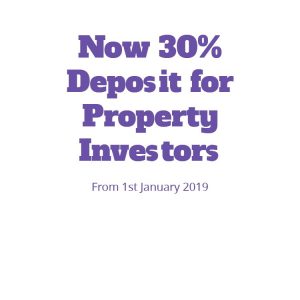

This week we saw the first bank come out and formally announce that they will be able to offer finance to property investors with a lower 30% deposit now.

The bank was the New Zealand owned SBS Bank.

This follows the recent announcement from The Reserve Bank.

Lower Deposit Requirement For Property Investors

As mortgage brokers we arrange a lot of finance for property investors.

When the Reserve Bank set the temporary limits on banks to reduce the amount of low-deposit mortgage lending they said that lending secured by investment property needed to have a deposit of 35%.

This meant a lot of people were locked out of the market.

We also saw those people that already owned rental property affected by these limitations.

Now the deposit criteria is being eased a little so that you now need a deposit of 30%.

Of course we were able to source property investor loans from non-bank lenders with only a 20% deposit; however the interest rates were higher. The LVR rules also do not apply to new builds so many property investors purchased new and were then able to use a lesser deposit.

Get An Extra 5% Now

We are expecting to see a lot of property investors looking to top up their lending by 5%.

This can make a difference especially if you have more than one rental property.

Contact a broker if you have questions or would like to have a look at your options.