A home loan is typically one of our biggest debts and therefore the repayments are significant too. Getting the lowest fixed rate mortgages is very beneficial and is something that we all want, but how do you know if your bank is going to offer you the best rate?

Achieve The Lowest Fixed Rate Mortgages

You already have a home loan with one of the banks and it’s about to come off a fixed rate. The bank send you a letter to explain this and you can either refix your loan on the rate offered or leave it in which case it goes onto the banks floating rate.

Generally the fixed rates are lower and your strategy has been to keep on the lower fixed rates.

There are three ways to refix your mortgage;

- You accepet the fixed rate offered in the letter

- You contact the bank and negotiate a lower rate

- You contact a mortgage broker to negotiate the lowest fixed rate mortgages on your behalf

The banks know that in most cases they can get away without offering you the lowest fixed rate mortgages and so they don’t, but they also know that a good mortgage broker knows what all the banks are prepared to offer and therefore they cannot get away with offering uncompetitive mortgage rates.

Don’t Accept The Advertised Mortgage Rates

The banks all have the standard home loan interest rates that they advertise on their websites.

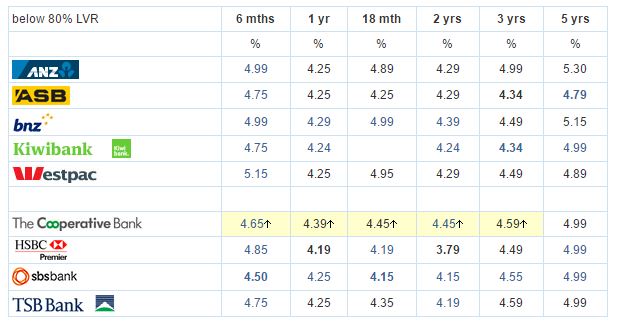

Today Co-Operative Bank lifted their home loan rates, but they are still not the highest in most cases. If you look at the table of rates above you will see that there is a huge variance between the highest and lowest fixed rate mortgages.

The highest 6-month fixed rate is Westpac at 5.15% and the lowest is SBS Bank at 4.50%. A mortgage broker would not accept the rate that Westpac is offering and would negotiate a rate to match or better the SBS Bank rate meaning you get lower Westpac interest rates.

If you look at the 2-year fixed rate then HSBC is advertising the lowest rate, but if you check the HSBC website there are conditions which means this is not available to everyone. Generally the 2-year fixed rate is a very competitive rate with most banks and as mortgage advisers we typically base our mortgage strategy around taking advantage of that. Of course in most cases we would not settle for the advertised rates and at the moment we are getting lower rates than those offered.

A property investor might want to fix at the 5-year fixed rate, but why would they accept the rate that ANZ is offering when they can get a lot lower fixed rate from ASB and that is without even trying to negotiate. Even the non-bank lenders like Resimac Home Loans offer a lower 5-year fixed rate of 5.03% and they are not bound by the LVR criteria that applies to property investors. Being a non-bank lender, Resimac Home Loans can still offer property investors loans of up to 80% through a network of selected mortgage brokers and Stuart Wills is one of those.

Let us help you getting the lowest fixed rate mortgages.