Plenty of people have opinions on what has happened in 2022, but few (if any) are prepared to offer any predictions for what might happen with the economy and the finances in 2023.

Of course, as mortgage advisers we get asked all the time for our opinions or comments if not predictions.

So rather than sit on the fence, we will share some opinions and comments here.

But we stress that these are just opinions and comments, and should not be treated as any form of financial advice. Things are just too fluid to allow anyone to provide anything solid, and as you will read here there are a lot of things that could change during the year.

Main Themes About Finances In 2023

In this article I will focus on what I believe are some major themes rather than get too bogged down in detail. I will share some opinions and comments here which you may agree or disagree with, and maybe in 12-months we will know how accurate these were.

The themes being discussed are:

- The Economy

- The Election

- Inflation

- Interest Rates

- House Prices

I will finish off with a small section on what I plan to do to manage the way through 2023.

The Economy

We have been told that the New Zealand economy has done well as we have navigated COVID, but I feel that is not really the case. Our economy has been propped up with money that was borrowed, and the problem with borrowed money is you need to pay interest on that money and also try and pay that money back.

Add to this the supply issues and the number of businesses that cannot find staff and it’s hard to see a nationwide recovery any time soon. Too many industries are finding things tough, and if it was not for our farmers things would be a lot worse.

Dairy prices are exceptionally strong, and we have seen generally strong commodity prices in meat, wood and fish exports too. But its been challenging for the horticulture sector with exports down particularly for apples, avocadoes, and stone fruits plus the wine sector which have all been hit hard with labour shortages.

Sure, some sectors of the service economy have been doing well and we’ve seen a huge spend on consultants, and until recently the building and trade sectors have been busy and making good money although that seems to have ground to a halt and we have seen a huge number of these business hit financial trouble.

Many home owners have probably felt quite wealthy too as they watched their house value increase, but now they may be questioning things as that wealth vanishes.

But as a country we measure our trading income using the current account, and after a period of improvement that has got significantly worse in the last 2-years. It’s twice as bad as the Global Financial Crisis.

If this was your household account then I’m sure you would be concerned and looking at every way to cut costs, and ultimately that is what the Government will need to be doing.

We already know that consumer confidence in New Zealand has fallen to its lowest rate on record. The Westpac McDermott Miller Consumer Confidence Index has fallen sharply in the December quarter, recording a 12-point drop since the September quarter results. According to the research company, this is the lowest consumer confidence has been since the survey began in 1988, indicating there are far more New Zealanders who are pessimistic rather than optimistic about the economic environment.

My Opinion / Comments:

I think the increased costs that have been loaded onto the business and the agriculture sector will have a real impact in 2023. Many businesses carry debt and so as well as higher interest costs they are being loaded with higher staffing costs and compliance costs.

I think we will see a surge in the number of businesses in financial trouble in early 2023, and this will mean a high number of redundancies and lay-offs.

If you are in business then take some time to look at the business and what you could do differently. If you think that you may want some finance then contact us early and set up a facility that you can access when and if needed – do this early while the lenders are still confident to lend as this may tighten up quite quickly. They say “cash if king” or at least access to cash is.

Like during the GFC I think we could see costal property values drop as business owners start selling their holiday homes.

But with the election coming up will they be prepared to tighten the purse strings?

The Election

Yes, there should be an election in 2023 and all indications are it will be the 25th November. While legally it can take place any time prior to January 13, 2024, the holiday season essentially rules out any date beyond the end of November and the Rugby World Cup runs from September 8th right through to the final on October 28th, with New Zealand matches scheduled for almost every weekend.

Currently the Labour Party looks to have fallen out of favour and the media are predicting that they will not be reelected; however assuming that the election is help in November there is a long time to go and plenty of opportunities for change.

The reason that I have highlighted the election as a key theme is we could expect that the Government will try and buy there way to another win. History has shown us that dishing out the cash does help at the election and that’s not so bad in normal years, but is 2023 a good time to be handing out the cash?

My Opinion / Comments:

At this stage I would think we will see a change in Government with a National Party led coalition taking over; however I expect that by the time the election comes around we will be in a different economic landscape and it might well see the minor parties holding a larger share of the seats.

I think the Labour Party will be punished for the state of the economy (which may not be all their fault) and also for the non-delivery on so many of their promises. I expect we will see mass resignations and they will need to rebuild as the National Party had to do.

Hopefully the pending election will stat to see a few good ideas floated by all parties.

Inflation

This is something that everyone has been speaking about and not just in New Zealand.

Inflation has hit a 30-year high and we’re told that it’s not good, but many people we speak to do not understand why most people are so concerned and yet some seem not to be.

In economic terms, inflation is the rate of increase in prices over a given period of time and as inflation increases you lose the purchasing power with your money – each dollar buys less. The only way to maintain the same lifestyle is to earn more, and that is not always as easy to do.

In New Zealand we use the consumers price index (CPI) as a measure of inflation which measures the percentage change in the price of a basket of goods and services consumed by households over a period of time.

My Opinion / Comments:

I believe that with the recent pay increases the consumer spending will remain high over the Christmas period and for the early part of the year, but then as redundancies start to hit people will tighten the belts.

By March / April I think we will start to see significant reductions to the inflation numbers led by the reduced costs of fuel and housing, and also by reduced consumer spending.

The unknown is Government spending which should also be reduced, but being election year I fear that they will keep spending in the hope of buying an election result.

We have written about inflation and why inflation must be controlled.

Interest Rates

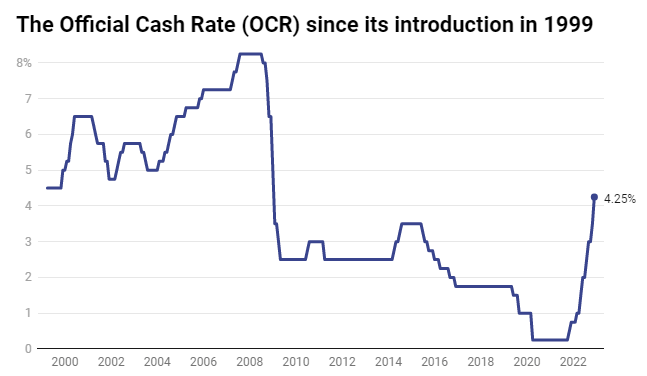

As mortgage advisers we know all about the rising home loan rates and the pressures that families are under. The Official Cash Rate (OCR) which is the basis of home loan rates has been at record lows for almost 10-years and yet in the last 12-months we have seen home loan rates increase at the fastest pace ever.

While most people knew that interest rates would increase, I don’t think anyone could have predicted how fast they would be pushed up.

But while we have high inflation we can expect the higher interest rates to remain.

We need to accept this, and have a look at what we can do to combat the high home loan interest rates. It’s not easy, and interest rates are expected to go higher too. The only real advise is that there are some things that we can do.

My Opinion / Comments:

Interest rates is the main mechanism that the Reserve Bank use to control inflation, so the expectation is that while we think there will me another increase in early 2023 (February) by mid year the inflation would have started to retreat and therefore I would expect the Reserve Bank would be comfortable to start to ease (reduce) interest rates.

With the economy under pressure too, the reduction of interest rates would be seen as a way to help stabilise jobs which is another role of the Reserve Bank.

I would encourage everyone to have a look at how they have their lending structured. Use the “learn more” button above to see some of our ideas, and reach out to discuss with myself or one of the team. It costs nothing to have a conversation and it could help a lot or at least put your mind at ease.

House Prices

I believe that house prices in 2023 will be driven by the lending environment rather than supply and demand.

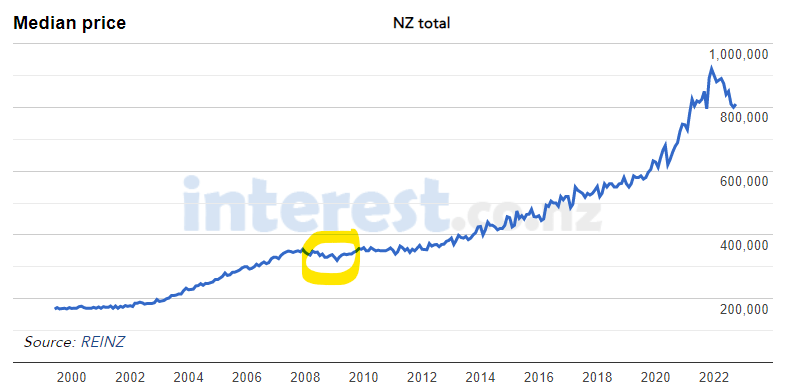

Typically the house prices are driven by demand, and as there have been more buyers then generally the house prices have increased. Prices have always gone up and down a bit and if you have a look at the graph below you will see previous dips like the GFC in 2008 / 2009 when everyone thought the house prices were dropping through the floor.

The graph also shows that house prices have recently dropped as we are all aware, but it also follows a period of insanely high increases. If you were to draw a line to track the average growth then you might say that it got a bit overinflated.

It’s important to understand that property values will increase and at times decrease, but the statistics that we hear about are generally “averages” and so it does not mean that the value of your home or any specific house will follow the same trend. Also if you own a house and don’t plan to sell then the value is not so important.

My Opinion / Comments:

I believe that KiwiBuild properties will no longer be seen as an attractive option and the Government will make some announcements on helping first home buyers in mid 2023. This might be an incentive with a special low deposit and low interest rate.

I expect that demand will remain low during 2023 and at least for the first half of the year the values will continue to soften, but not in all areas. Good houses in popular areas will still sell okay as people can buy and sell in a similar market. If you have a good solid income then it could be a good time to look at changing / upgrading homes and there may be some good opportunities to buy holiday homes.

My Tip To Help Get Through 2023

It may be a stressful year; however you can only focus your efforts on what you can control.

There are often things that you cannot control and you can waste a lot of effort and stress a lot about those; however in reality you cannot do anything about them. Instead you are better to identify what you can control and do the best to manage those parts of your life.

Stuart Wills – from Life Experience and the Global Financial Crisis

What Will I Personally Do Or Suggest

As you will gather by now, I believe that 2023 will be a challenging year.

During the year we personally have a home loan that comes off the low fixed rate, and of course this will be refixed on a much higher rate and that means higher repayments. I can assure you that we are not looking forward to that as it’s money that is spent for no extra benefit, but I guess we should also be grateful that we had the benefit of the low interest rates.

We cannot do much about the higher interest costs, so income needs to be a real focus in 2023. In our business of financial services that means being more efficient and being able to offer a greater selection of products and services.

We have already started expanding what we can offer with our new brand Smarter Loans that is doing personal lending including debt consolidation and vehicle finance as well as business lending. We’ve also refocused on offering insurances and Kiwisaver and are able to provide some very good options with these, plus we have sourced options for doing documentation online like wills and relationship property agreements.

The other area that we will be looking at is any “other” interest that we pay on either credit cards, loans or even arrangements like insurance where there is additional cost for paying monthly rather than annually. We will be looking at all our main costs to see if there is a better, better value, more efficient or another way to doing things.