It’s hard for first home buyers these days and so we have put together some tips for first home buyers using their KiwiSaver in an effort to help.

KiwiSaver was introduced in 2007 as a retirement scheme with a focus to lift New Zealand’s poor record of savings. As well as being a retirement scheme, it was recognised that people needed a way to save for their first home deposit and so they allowed people to withdraw money for their first home provided that they had been contributing to KiwiSaver for 3-years or more.

We’ve now had KiwiSaver for a few years and over 3 million of us have a plan, and the number of people using KiwiSaver for their first home has been increasing over the years too.

Here Are Some Tips For You

Remember these tips may apply to your situation, but are given as things to consider rather than specific financial advice. You should always speak to one of our mortgage advisers who can review your situation and then be able to provide you advice that is specific to you.

Here are the questions and answers:

Do I qualify to use my KiwiSaver for my first home?

If you have been a member of KiwiSaver and contributing for at least 3 years, you may be able to make a withdrawal from your savings to put towards buying your first home. If you want to use your KiwiSaver then you should check the criteria with Kāinga Ora and you can apply for a pre-approval which gives certainty.

What type of KiwiSaver fund should a first home buyer be in?

Most KiwiSaver providers have a range of funds from conservative to aggressive which you can choose from. The aggressive funds have more growth assets like shares so while they should provide higher returns over the long term they are more volatile too; therefore they can drop in value too. Conservative funds tend to focus on cash and bonds which provide lower but more stable returns and therefore are safer for those people that may have shorter timeframes to invest – like first home buyers who may need to withdraw their money sooner.

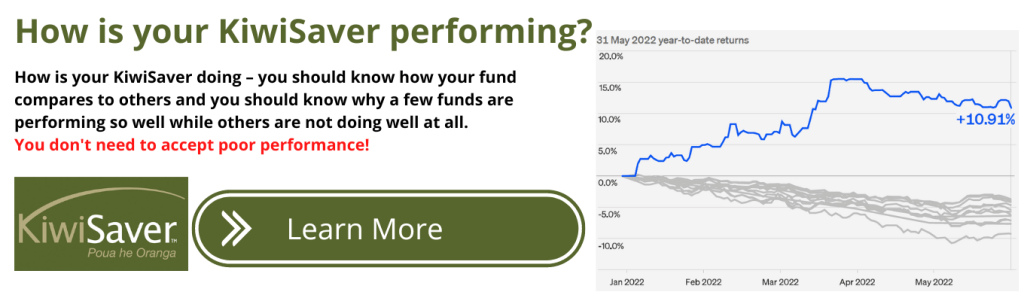

You should also make sure that you are with the right KiwiSaver provider – you can switch your KiwiSaver if needed.

Does it matter which KiwiSaver provider I use?

There are a number of KiwiSaver providers and they all do things a little bit differently. It’s easy to switch and if you are not happy with your current KiwiSaver then you should change.

You should switch providers if you are with one that is not providing the best options.

But also you should delay switching if you plan to be buying within 15-20 days as from the time you complete the application to switch and pass the AML, it generally takes 10-15 business days for the balance to be available in your account so cannot be withdrawn during this time.

How much can I withdraw from my KiwiSaver?

If you’re eligible, you can withdraw most of your KiwiSaver funds for buying your first home. Eligible members can withdraw their KiwiSaver savings (including tax credits); however at least $1,000 must remain in their KiwiSaver account. Also you can’t withdraw any amounts transferred from an Australian complying superannuation scheme. It’s always a good idea to check with your provider and they can provide you a letter confirming what you can withdraw, and your mortgage adviser or bank will require this letter for your mortgage application too.

How much should I contribute to KiwiSaver?

For most people employed on wages and salaries you should contribute a minimum of 3% as your employer will match you with another 3% plus you may receive the annual tax credit payment which is the government contribution to an eligible member of $521.43 which is paid if you contribute at least $1042.86 of your own money between 1 July to 30 June each year.

Of course you can increase your KiwiSaver contributions and should especially if you are not good at saving elsewhere and many people saving for their first home will increase their contributions from 3% to 4%, 6%, 8% or 10% of your pay. If you are a good saver then you may wish to stay with the 3% contribution and save elsewhere where you can easily access the money for the house deposit or other costs when required.

Can you add lump-sums to your KiwiSaver?

Yes, you can add lump-sums to your KiwiSaver and many people do. It can be a good way to save extra for your first home and especially of you are not a good saver and may be tempted to raid normal bank savings. Often parents can also add to your KiwiSaver as a lump-sum knowing that you cannot spend the money. A parent can add to your KiwiSaver and know that you can only withdraw that money for your first home, and generally the banks do not check where that money came from either as they would assume that it has been built up over time. You would want to be very sure that you are eligible to withdraw your KiwiSaver before you (or anyone else) deposits a lump-sum as otherwise it could be locked in until your retirement.

Can I reduce my Kiwisaver contributions when I buy my home?

Yes, you can reduce your KiwiSaver contributions to the standard 3% or you can even put your contributions on hold for a period.

When applying for a mortgage your KiwiSaver contributions are treated as a financial outgoing (expense) and therefore it has a negative impact on what the bank will let you borrow. For this reason it can be helpful to apply for a temporary break from paying into your KiwiSaver account (called a ‘savings suspension’) so it allows the bank to approve your mortgage to a higher level. You would need to do this before applying for the mortgage so that your payslips do not show the deduction for KiwiSaver contributions. Speak to your mortgage adviser and they can show you the difference that this could make for you.

What other non-KiwiSaver ways are there for savings a first home deposit?

In New Zealand most first home buyers use KiwiSaver for saving a first home deposit, but also have to use money saved in their bank accounts. For short-term savings standard bank accounts are fine as you are not concerned with how much interest you earn, but if you are saving over a longer term then earning extra interest or income on your savings can make a huge difference. There are a range of interest bearing accounts from the main trading banks and other more niche banks, plus there are other investments that invest in a range of things from the cash and conservative funds to the more aggressive funds that can potentially earn more but are designed for longer term investors as they can lose money too.

What bank offers the best home loan for first home buyers?

There is no one bank that offers the best home loan for first home buyers as everyone’s situation is a bit different and banks are constantly changing their criteria. For most first home buyers one of the biggest challenges is being able to save a big enough deposit and therefore if you have less than 20% deposit your options may be limited, and selecting the best home loan might not be an option, instead it might be taking a home loan with whichever bank is prepared to loan you the money required. The Government through Kainga Ora assist with the First Home Loans scheme which guarantees part of the loan for some banks

Are non-banks a good option for first home buyers with KiwiSaver?

Sometimes a non-bank will offer finance for first home buyers when banks don’t. In many situations where you might have good income but a low deposit then you may be able to get a 1st mortgage and a 2nd mortgage with non-bank lenders and this allows you to buy your first home where otherwise it may not be possible. You can use your KiwiSaver and it must be applied to the purchase. The non-bank options may be short-term options to get into your home, and then you either focus on paying the 2nd mortgage off (maybe with your KiwiSaver on hold) or look to refinance to a bank once the house price increases and gives you the required equity.

That’s ten tips for first home buyers using their KiwiSaver, and we hope that they have been helpful.

It’s always a good idea to speak to a mortgage adviser who can help you through the process of getting ready and then applying for a home loan.