Today Westpac have introduced a re-documentation fee of $170 which will apply for those transactions that require new loan documentation or changes to their lending facilities of a “significant nature” where there is no new lending involved.

The fee again reflects the time involved in attending to these requests.

As mortgage brokers we have just been advised of this new fee, but have not yet been advised what a “significant nature” really means.

Refixing Westpac Loans

There is still no charge for refixing any Westpac home loans or fixing from floating where there is no change to the loan itself other than the rate.

Of course as mortgage brokers we will always fight hard to get you lower Westpac interest rates. The banks including Westpac tend to offer their customers home loan interest rates which they think you will accept, but as brokers dealing with this every day we know when we see rates that are not competitive – and this is a common occurrence.

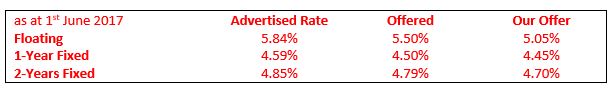

Just today I had an example with Westpac where we were able to save a couple quite a bit;

The funny thing is these clients had originality arranged the Westpac home loan themselves, directly with the branch. They had been offered what appeared to be quite a good discount from Westpac but by chance they thought they would ask what we could do, but not expecting anything better.

But we did manage to get lower interest rates from Westpac.

We usually do get at least the same if not better rates, and we get paid by the banks so you can check how well we can do without it costing you anything.

Banks Moan About Offering Discounted Interest Rates

The banks are always trying to explain to people how there is no margin – how they have offered the lowest rates possible. In some cases they do offer very low interest rates, but often the rates they offer are not as good as they could be.

The same can be said about this new fee – they have justified it based on the time it takes.

But the banks are still doing okay.

In fact Westpac was reported in Stuff this May saying the New Zealand profit was up 2 per cent, year-on-year which helped the Australian-based bank reported a A$4.017 billion (NZ$4.31 billion) cash profit for the first half of the financial year.

Talk To A Mortgage Broker

Rather than rely on Westpac or any bank to provide you the ‘best deal’ you would be better off to speak with a mortgage broker.

You can contact a broker on:

Freephone: 0800 100 939

Email: [email protected]

Let us help you get treated right by your bank.