With the sharemarkets around the World in turmoil many people are concerned as they see their KiwiSaver balances dropping, but some are feeling more comfortable in the knowledge that they have protections in place.

High inflation, rising interest rates, the fear of recession and the ongoing war in Ukraine are combining to put real pressure on markets.

It’s a bit “ugly” for many investors, but there is also opportunity for those that are prepared.

We ask you how your KiwiSaver is doing – you should know how your fund compares to others. We then discuss diversification, managing asset allocation and downside mitigation. These are three key components that you should consider when selecting which fund manager you want to look after your KiwiSaver.

How’s Your KiwiSaver Doing?

It’s a tough year for many investors who have been used to the “good times” and have not been prepared for times like we are currently in. Many investors and fund managers are seeing their investments eroding this year, but some are performing okay.

Of course if you are young then you should treat your KiwiSaver as a long-term investment and not get too concerned if there are periods where it falls, as it should bounce back again. What is often a concern though is when your KiwiSaver drops while others don’t … it’s a time when you should consider why that is happening and ask yourself if your provider is looking after you and your money.

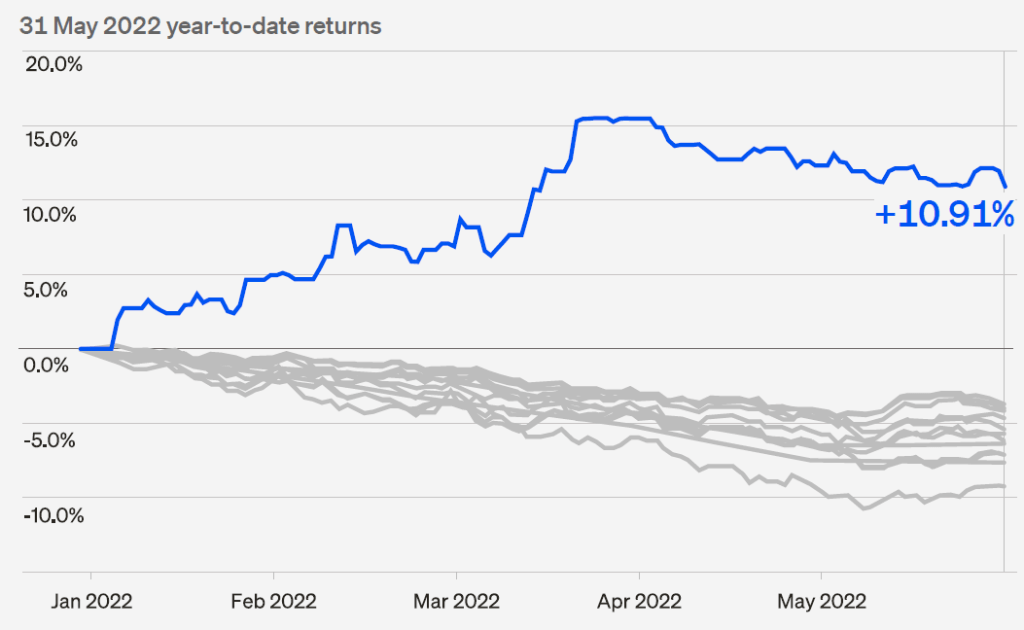

This graph illustrates how most KiwiSaver funds are performing with one that stands out. These are all Conservative KiwiSaver funds and of the 13 funds all except the 1 fund highlighted have lost their investors money.

If you chose to be in one of these funds then the obvious choice would be the fund that is outperforming all others, but it’s just as important that you understand why this has happened while it’s a great result it will hopefully not happen all of the time.

This stand-out fund benefited from downside mitigation.

Don’t Rely Just On Diversification

Diversification is good, but it isn’t what it used to be.

The problem is that most KiwiSaver fund managers have diversified by investing in both shares and bonds, but when both fall so does your investment values.

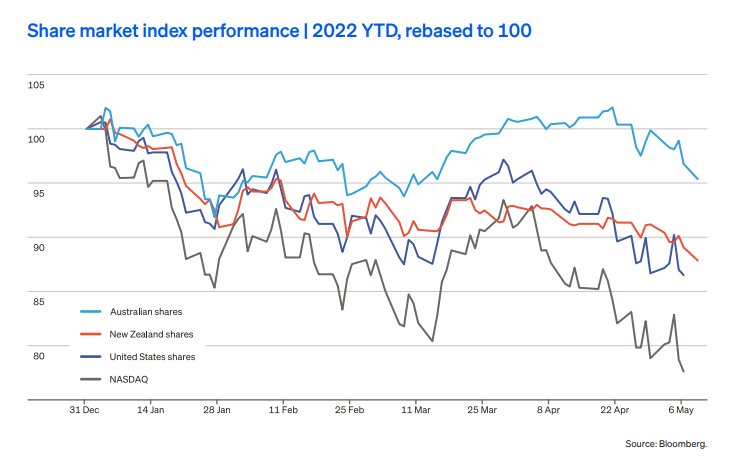

For most of 2022 so far the financial markets have been falling.

Sharemarkets are down around the world with the S&P 500 down over 15% this year and the NASDAQ is down 25%. It’s not just isolated to the United States sharemarkets, the local New Zealand and Australian sharemarkets have felt the impact too.

At the same time the bond markets have had their worst start to a year in decades.

Does Your KiwiSaver Adjust Asset Allocation For Age?

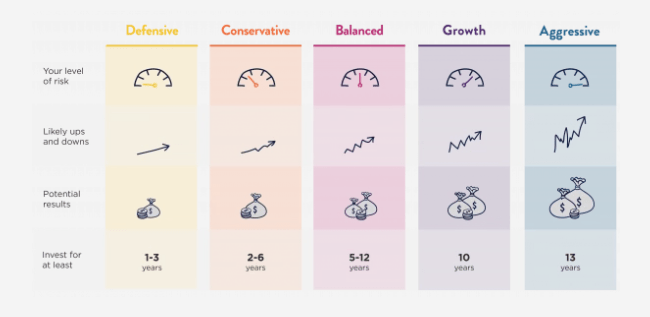

A lot of financial advisers and KiwiSaver providers talk about the various asset allocations that are used depending on your tolerance for risk and time for an investment. The general rule is that if you are investing for longer then you can accept a higher level of risk in the hope that over the long-term you will get a larger return.

A problem with selecting funds in this way is making sure that you change funds as your timeframe reduces. You may set up your KiwiSaver when you are ‘say’ 50-years old and assume that you will retire and want the money out in 15-years in which case using the above you would invest in an Aggressive Fund. But 8-years later you will still be in that same Aggressive Fund unless you have made a change.

Most people don’t focus much on KiwiSaver and don’t make those changes.

Can you automate KiwiSaver fund selection?

It is becoming more popular to automate fund selection with Kiwisaver using a life cycle option that some providers have. This way the fund selection gets rebalanced automatically as you get older and nearer to retirement when KiwiSaver is going to be used. It helps avoid being caught out in a higher risk fund than you should be, especially as most people do not have a financial adviser reviewing their KiwiSaver investments.

Some of the KiwiSaver providers have an option to select a “life cycle” option, which adjusts the asset allocation as you get older and this way keeps you with an asset allocation that matches with age. It’s a “set and forget” type allocation where the provider makes the adjustments automatically for you and this way ensures that you are not taking more risk than your investment timeframe deems appropriate.

Downside Mitigation Is Important

If you follow investment markets you may have heard people talking about things like downside mitigation.

But what is it, and more importantly does it work?

What is downside mitigation?

Downside mitigation is a process of having strategies aim to reduce the frequency and/or magnitude of capital losses, resulting from significant asset market declines. One method is to purchase options which insure against negative market movements.

In life we will often pay for an insurance policy which provides financial compensation should an unforeseen event happen and cause us a financial loss. We have house insurance in case our home burns down, and the insurance means that we are provided the funds to rebuild. We have our car insured so we can fix or replace it if we are involved in an accident.

But most people don’t have their investments insured.

People don’t really like insurance as it costs money and is hopefully not needed. But when events happen it’s often a regret that we don’t have insurance.

Most people have probably never considered insurance on their investments or have not considered it a worthwhile component to have within an investment strategy.

Universa is a hedge fund with it’s flagship “Black Swan Protection Protocol” which provides institutional investors some protection against a plunge in markets. In plain English it acts like an insurance policy and means when a rear black swan event happens (a Global Financial Crisis, terrorists fly jets into skyscrapers, or a global pandemic freezes the global economy) then the fund cashes in option contracts and the investors receive large payouts. Forbes report that it’s institutional investors earned a staggering 3,612% in March 2020 when COVID shocked the world and markets plunged.

How Well Is Your KiwiSaver Performing For You?

Like any investment it is important to take some time and review how your Kiwisaver is performing for you, and that includes how it is set up and how it performs.

We have discussed diversification, managing asset allocation as you age and downside mitigation including how Universa has acted like an insurance policy for those institutional investors that opted for the protection offered with the Black Swan Protection Protocol.

These are three key components that we believe you should consider when selecting which fund manager you want to look after your KiwiSaver.

Let’s check what your KiwiSaver provider offers.