What do you want from a finance blog?

We’re guessing that you want good information about all things finance related.

That’s what we have been told, and therefore we do our best to provide updates on a wide range of topics. We help a lot of first home buyers and have New Zealand’s most popular Facebook Group dedicated to them. We also deal a lot with new build finance and non-bank finance as well as the major banks.

We also like to add some stories too as these often help explain how our mortgage advisers can help.

We are proud of the information that we publish in both our Kiwi Edition Market Reports and our finance blog, and we hope that you can find useful information too.

Please use the “search” function below, or feel free to Contact Us with any questions too.

Search Our Finance Blog

How Far Away Is Open Banking In New Zealand

With the banks recently announcing more record profits there has been more talk of seeing open banking in New Zealand,

Soft Property Markets Offer Opportunities For Buyers

It’s always interesting that in soft property markets people tend to hold off buying, and yet when the market is

Bank Assessments Can Be Hard On Property Investors

As mortgage advisers we are often contacted by property investors who struggle to understand how the banks assess their loan

Six Things To Combat High Home Loans Interest Rates

Yes, we have high home loan interest rates and we could have these for a few years. We have had

Are You Sitting On The Fence Still?

Too often Kiwis will accept poor performance and just go with the flow. But we shouldn’t really do that. The

Best Personal Loans For Debt Consolidation

Not all personal loans are created the same, some are very expensive so while they may give you a “fast

Ten Tips For First Home Buyers Using Their KiwiSaver

It’s hard for first home buyers these days and so we have put together some tips for first home buyers

When Should I Switch My KiwiSaver?

When I was not happy with my KiwiSaver fund manager and the way it was invested in then I knew

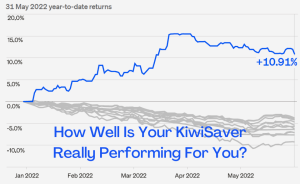

How Well Is Your KiwiSaver Really Performing For You?

Like any investment it is important to take some time and review how your Kiwisaver is performing for you, and